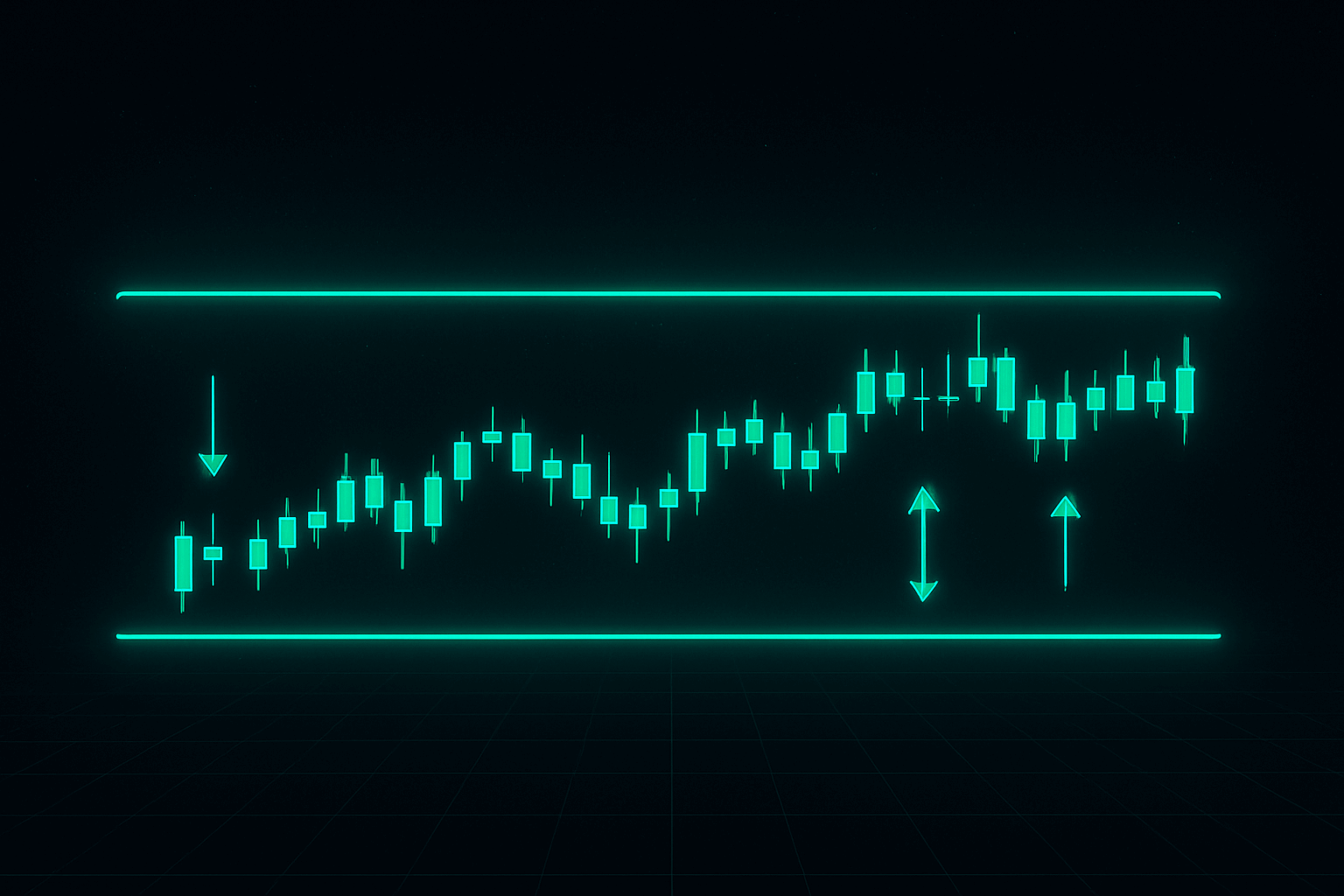

Range trading is a systematic approach that capitalizes on markets moving within well-defined horizontal boundaries. Unlike trend-following, which seeks to exploit directional price movements, range trading assumes that prices oscillate between support and resistance levels over extended periods.

This approach is particularly relevant in the foreign exchange market, where macroeconomic stability or lack of new information often causes currencies to trade sideways for months. It is also widely used in equities, commodities, and cryptocurrencies during phases of consolidation.

Range trading is regarded as one of the most accessible strategies for analysis, yet mastering it requires discipline, risk control, and a keen understanding of market conditions.

The Logic of Range-Bound Markets

Financial markets alternate between trending and consolidating phases. Studies suggest that prices may spend up to 70–80 percent of the time trading within ranges, with only 20–30 percent in strong directional trends.

Ranges form when supply and demand reach a temporary equilibrium. Buyers consistently step in at lower levels (support), while sellers emerge at higher levels (resistance). The resulting price action resembles oscillation within a channel until new information breaks the balance.

For traders, this presents repeated opportunities:

- Buy near support with a stop below.

- Sell near resistance with a stop above.

- Capture profits as prices revert back to the midpoint or opposite boundary.

Historical and Practical Examples

Foreign Exchange Consolidations

The EUR/USD pair is well known for prolonged sideways trading. For example, between 2015 and 2017, it traded between 1.05 and 1.15 for nearly two years before breaking out. Traders applying range strategies captured repeated swings inside this 1,000-pip corridor.

Equity Market Sideways Phases

The S&P 500 index often pauses after strong rallies, consolidating for several months within a limited range. These periods allow range traders to exploit repeated reversals before the index resumes its broader trend.

Commodities Cycles

Gold frequently alternates between trending and range-bound behavior. In 2012–2018, gold traded between 1,050 and 1,400 USD for nearly six years. Range traders executed profitable long positions at lower boundaries and short positions near the upper limit.

Technical Implementation

Identifying Support and Resistance

The cornerstone of range trading lies in accurately defining horizontal boundaries:

- Support: A level where buying interest repeatedly prevents further declines.

- Resistance: A level where selling pressure consistently caps upward movements.

Tools for Confirmation

- Bollinger Bands: Help visualize volatility and extremes within the range.

- Relative Strength Index (RSI): Overbought conditions near resistance, oversold near support.

- Volume Analysis: Decreasing volume within the range suggests balance; spikes in volume may precede breakouts.

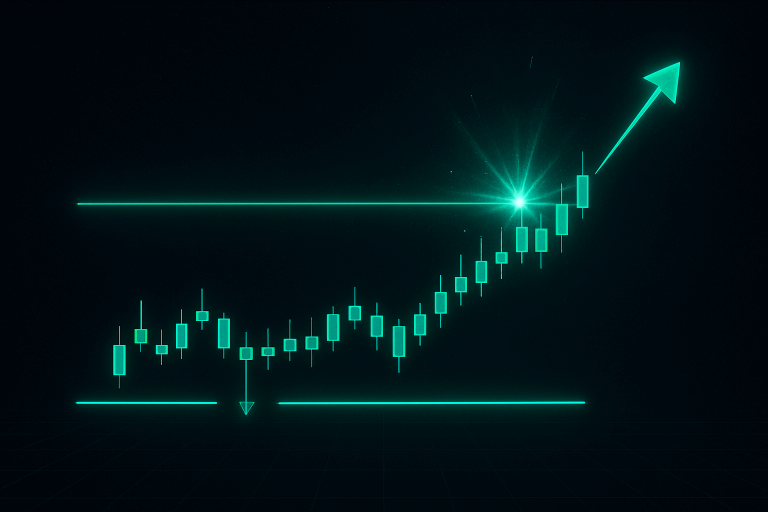

Trade Execution

- Enter long positions near support once price stabilizes.

- Enter short positions near resistance with signs of exhaustion.

- Exit positions near the midpoint or opposite boundary of the range.

- Always place protective stops just outside the defined levels to guard against unexpected breakouts.

Advantages and Limitations

Advantages

- Works in the majority of market conditions, since ranges dominate much of the time.

- Clear entry and exit rules based on visible chart structures.

- Allows for multiple opportunities within the same range.

Limitations

- Vulnerable to sudden breakouts, leading to significant losses if stops are ignored.

- Requires frequent monitoring; ranges may shift or collapse without warning.

- Less effective in strong trending environments.

Algorithmic Range Trading

Algorithmic models can efficiently capture range dynamics by codifying support and resistance detection, entry logic, and risk controls.

Example of algorithmic workflow:

- Automatically calculate recent price highs and lows to define the range.

- Use oscillators (e.g., RSI or Stochastic) to confirm overbought/oversold signals.

- Place limit orders near boundaries with predefined stop-losses just beyond the range.

- Exit positions at the opposite side or once risk–reward targets are achieved.

Algorithmic range strategies are particularly effective in highly liquid markets where price oscillations are frequent but breakouts are rare. Robots remove the temptation to “chase” moves and maintain discipline, especially when range trading requires repeated execution of similar setups.

Best Markets for Range Strategies

- Major Forex Pairs: EUR/USD, USD/CHF, and AUD/USD often consolidate for extended periods.

- Gold and Silver: Precious metals frequently enter long sideways phases between macroeconomic catalysts.

- Equity Indices: FTSE 100, DAX, and S&P 500 often spend months within well-defined ranges after strong moves.

- Cryptocurrencies: Despite their volatility, Bitcoin and Ethereum frequently exhibit horizontal consolidations between major bull or bear cycles.

Practical Considerations

- Ensure that ranges are well established with multiple touches of both support and resistance.

- Avoid trading ranges that are too narrow; transaction costs may erode profitability.

- Use stop-loss orders consistently, as breakouts can be sudden and sharp.

- Combine with volatility filters (such as ATR) to avoid periods of extreme expansion.

- Consider scaling out of trades to lock in partial profits within the range.

Conclusion

Range trading is a powerful and versatile strategy, particularly suited to markets that lack a strong directional bias. By systematically identifying support and resistance and executing trades with discipline, traders can repeatedly exploit price oscillations.

While breakouts represent the primary risk, proper use of stops, confirmation tools, and algorithmic execution can significantly reduce exposure. The strategy is especially effective on liquid instruments such as major currency pairs, gold, and equity indices, where extended consolidations are common.

Range trading complements trend following in a broader portfolio of strategies: while trends capture large moves, ranges provide frequent, incremental opportunities. Together, they form a balanced framework for navigating diverse market conditions.