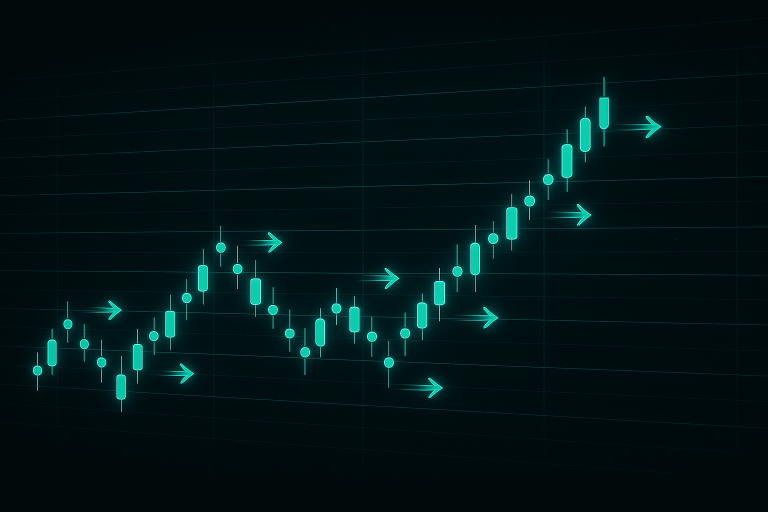

The breakout trading strategy is one of the most dynamic and widely practiced approaches in financial markets. A breakout occurs when the price moves decisively beyond a well-established support or resistance level. Traders interpret this event as the beginning of a new directional move, often accompanied by increased volatility and trading volume.

Breakout trading is especially popular in forex, stock indices, and commodities, where extended periods of consolidation are followed by sharp movements. The principle is straightforward: once price breaks through a barrier that has previously contained it, the probability of continuation in the same direction increases significantly.

This strategy attracts both discretionary traders and systematic algorithmic models, as breakout rules can be codified into objective entry and exit conditions.

The Logic of Breakouts

Markets typically alternate between two phases: consolidation and expansion. During consolidation, price oscillates within a narrow range, reflecting equilibrium between supply and demand. Breakouts mark the transition from balance to imbalance.

The psychology behind breakouts is driven by market participants’ positioning. Traders who bought near support or sold near resistance are forced to act when those levels fail, adding momentum to the new move. Simultaneously, new traders enter in the direction of the breakout, further amplifying the trend.

Historical and Practical Examples

One of the most famous breakout examples is the British pound’s sharp decline on “Black Wednesday” in September 1992. When the Bank of England abandoned its defense of the pound’s peg within the European Exchange Rate Mechanism, GBP/USD broke support and collapsed by more than 10 percent in a matter of days. Traders who recognized and followed the breakout captured historic profits.

In equities, technology stocks frequently provide breakout opportunities. For instance, Tesla repeatedly formed consolidation ranges in 2019 and 2020 before breaking out to all-time highs. Traders applying breakout strategies during these phases captured significant upward moves.

In commodities, crude oil prices in 2020 broke long-standing support levels as global demand collapsed during the pandemic. Breakout traders who entered on these levels participated in one of the most volatile price movements in energy market history.

Technical Implementation

Identifying breakout opportunities requires combining price action with technical indicators.

Support and resistance levels are the foundation. These can be horizontal lines derived from previous highs and lows, trendlines connecting multiple swing points, or psychological round numbers such as 1.2000 in EUR/USD.

Volume is a key confirmation tool. A breakout accompanied by high trading volume is more reliable than one occurring on low volume.

Indicators such as Bollinger Bands or Average True Range (ATR) are often used to confirm volatility expansion. Many traders also employ momentum oscillators like RSI to ensure that the breakout is not occurring in overextended conditions.

A classic method of execution is to place buy stop orders just above resistance or sell stop orders just below support. Protective stop-losses are set inside the consolidation area, while profit targets are often measured based on the height of the consolidation pattern.

Advantages and Limitations

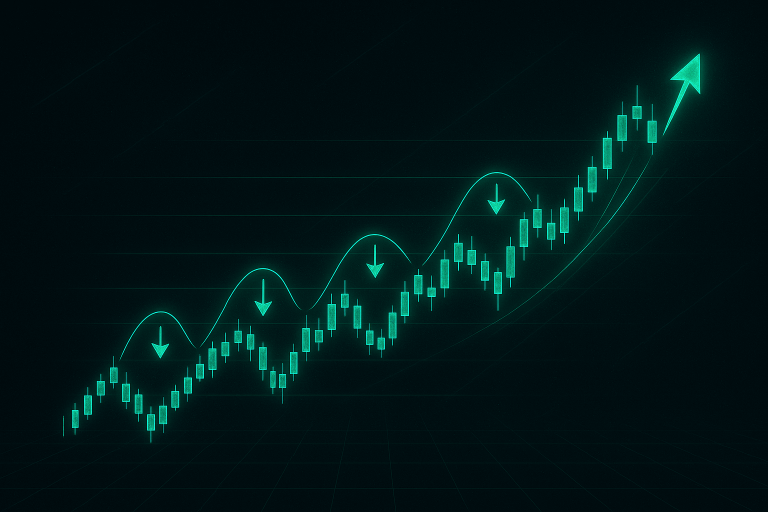

Advantages of breakout trading include the ability to capture large and fast moves early in their development. Breakouts often mark the beginning of a strong trend, offering significant reward relative to risk.

Limitations arise from the prevalence of false breakouts. Price may briefly breach a level before reversing, trapping traders in losing positions. To mitigate this, many professionals require confirmation such as a daily close beyond the level, increased volume, or multiple indicator alignment.

Algorithmic Breakout Trading

Breakout strategies are well suited for algorithmic implementation due to their rule-based structure. A trading robot can continuously monitor multiple instruments, detect when price breaches predefined ranges, and execute trades instantly.

For example, an algorithm may:

- Identify the highest high and lowest low of the past 20 sessions.

- Place buy stop orders above resistance and sell stop orders below support.

- Confirm the breakout with ATR expansion or a volume filter.

- Apply trailing stops to protect profits as the move develops.

Automated breakout systems are widely used in forex breakout trading because currency pairs often consolidate for extended periods before sharp moves. Robots are particularly effective in executing these setups without hesitation, something human traders often struggle with.

Best Markets for Breakout Trading

Breakout strategies are effective in markets characterized by frequent consolidations followed by strong directional shifts.

Forex pairs such as EUR/USD, GBP/USD, and USD/JPY are prime candidates, especially around major macroeconomic announcements or central bank decisions.

Stock indices like Nasdaq and DAX provide breakout setups when consolidations form near record highs or after corrections.

Commodities, including gold and crude oil, are well known for prolonged sideways phases that resolve with powerful breakouts.

Cryptocurrencies such as Bitcoin and Ethereum are highly suitable for breakout trading due to their tendency to alternate between consolidation and explosive price movements.

Practical Recommendations

To increase success probability in breakout trading:

- Focus on clearly defined support and resistance levels tested multiple times.

- Combine breakout entries with confirmation from volume or volatility indicators.

- Avoid trading in low-liquidity hours, as these often produce false signals.

- Set stops within the consolidation range to limit risk.

- Consider scaling into positions, adding once the breakout shows strength.

Conclusion

Breakout trading is a cornerstone of active trading strategies. By identifying periods of consolidation and positioning for volatility expansion, traders can capture substantial price movements. The approach is versatile, applicable across forex, stocks, indices, commodities, and cryptocurrencies.

The main challenge is filtering false breakouts. This can be addressed through volume confirmation, indicator filters, or algorithmic automation. Robots excel at monitoring multiple instruments and executing breakouts instantly, making algorithmic breakout trading an attractive solution for modern traders.

When applied with discipline, proper risk management, and confirmation techniques, breakout trading offers one of the most direct and potentially profitable ways to align with market dynamics.