Swing trading is a medium-term trading approach that seeks to capture price movements within an existing trend or during periods of short-term market swings. Unlike day trading, which focuses on intraday fluctuations, or long-term investing, which holds positions for months or years, swing trading operates on a time horizon of several days to several weeks.

The key principle of swing trading is to identify temporary price retracements or accelerations within a broader trend and profit from them. Swing traders aim to buy near short-term lows and sell near short-term highs, or to short near local peaks and cover near troughs. This makes the method attractive for traders who cannot monitor markets continuously but still want to participate actively.

The Logic of Swing Trading

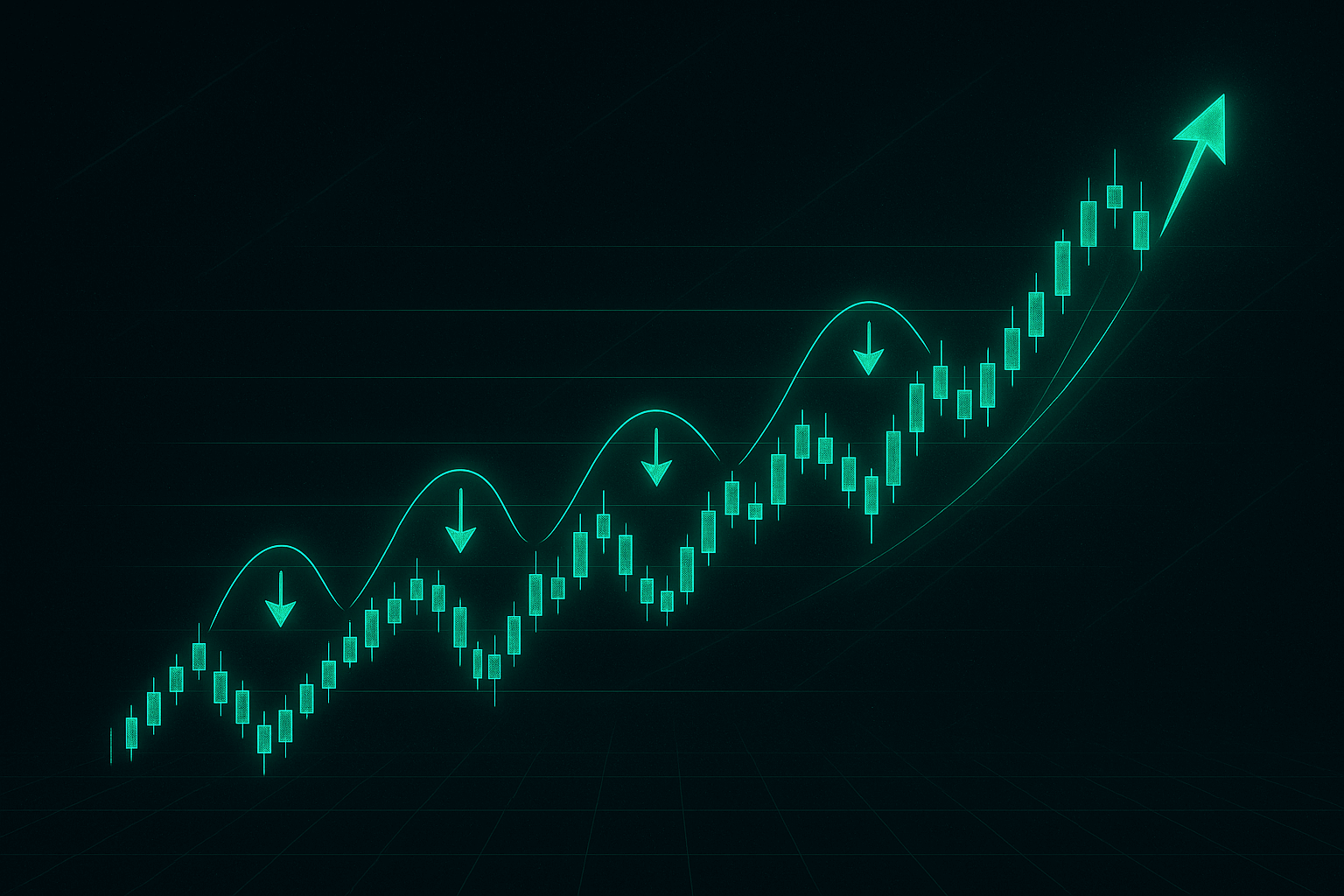

Markets rarely move in a straight line. Even within strong trends, prices typically advance in waves, alternating between impulse phases and corrective pullbacks. Swing trading takes advantage of these fluctuations.

In an uptrend, swing traders look for price corrections toward support or moving averages to establish long positions. In a downtrend, they search for rallies toward resistance to enter short positions. Profits are realized when price returns to the primary trend’s direction and resumes momentum.

This cyclical rhythm makes swing trading highly adaptable. It is effective in both trending and range-bound markets, provided traders can recognize where the short-term risk–reward profile is favorable.

Historical and Practical Examples

In the equity market, swing strategies are commonly applied to blue-chip stocks and exchange-traded funds. For example, during the 2020 recovery from the pandemic crash, the S&P 500 index advanced in multiple stages. Swing traders repeatedly bought retracements toward 20- and 50-day moving averages and exited as price reached new short-term highs.

On the forex market, EUR/USD has historically provided numerous swing setups during macroeconomic uncertainty. When the pair fluctuated between 1.08 and 1.12 in 2019, swing traders exploited repeated reversals from boundaries to capture several hundred pips over a few weeks.

In commodities, gold often provides strong swing opportunities. For instance, in 2016, gold prices rebounded from $1,050 to $1,375 in a series of waves. Traders who bought pullbacks during the move captured significant profits without holding through the entire multi-month cycle.

Technical Implementation

Tools for Identifying Swings

- Moving Averages: Dynamic support and resistance for trend retracements.

- Fibonacci Retracements: Frequently used to identify likely correction zones (38.2%, 50%, 61.8%).

- Momentum Indicators: RSI and Stochastic help detect overbought or oversold conditions during swings.

- Chart Patterns: Flags, pennants, and wedges often indicate continuation swings within trends.

Trade Execution

- Identify the dominant market trend.

- Wait for a counter-trend correction.

- Enter in the direction of the broader trend when momentum resumes.

- Place stop-loss orders below recent swing lows in an uptrend, or above swing highs in a downtrend.

- Set targets at prior highs/lows or use trailing exits.

Advantages and Limitations

Advantages

- Flexible timeframe, suitable for traders who cannot monitor markets every hour.

- Opportunities arise frequently across asset classes.

- Captures both trending moves and range oscillations.

- Lower transaction costs compared to high-frequency methods.

Limitations

- Requires patience; trades last days to weeks.

- Subject to overnight risks such as gaps in equities or forex news shocks.

- Demands precise timing to balance between too early and too late entries.

Algorithmic Swing Trading

Swing trading can be effectively automated, though it requires careful coding of entry and exit conditions. Algorithms can scan for pullbacks, confirm momentum reversals, and place trades without delay.

A typical swing trading robot might:

- Detect an established trend using moving averages.

- Identify retracements of 30–60% of recent moves.

- Confirm reversal with momentum indicators.

- Open trades in the direction of the trend.

- Manage exits using volatility-based trailing stops (e.g., ATR).

Swing trading automation is well suited for liquid instruments like major forex pairs, equity index futures, and high-volume stocks. By eliminating human hesitation, algorithms capture opportunities consistently while managing risk.

Best Markets for Swing Trading

- Forex: EUR/USD, GBP/USD, and AUD/USD frequently provide multi-day swings within broader macro cycles.

- Equities and ETFs: Large-cap stocks such as Apple or Microsoft, and index ETFs like SPY or QQQ, often show retracements that fit swing setups.

- Commodities: Gold, silver, and oil display repeating wave structures suitable for swing trading.

- Cryptocurrencies: Bitcoin and Ethereum exhibit pronounced multi-day swings, though higher volatility requires stricter risk management.

Practical Recommendations

- Combine trend analysis with swing identification: trade pullbacks in the direction of the larger move.

- Use multiple timeframes: confirm setups on daily charts while refining entries on 4-hour charts.

- Apply strict stop-losses to manage overnight risk.

- Scale out of positions to secure partial profits.

- Keep position sizes moderate, as swings may last longer than expected.

Conclusion

Swing trading offers a balanced approach between the intensity of day trading and the patience of long-term investing. By focusing on short- to medium-term price movements, swing traders capture frequent opportunities without the need for constant monitoring.

Its adaptability across forex, equities, commodities, and cryptocurrencies makes swing trading one of the most versatile strategies in modern trading. With algorithmic automation, the method becomes even more powerful, ensuring discipline in entries, exits, and risk management.

When executed with a clear plan and consistent methodology, swing trading provides traders with a structured framework to harness market fluctuations and build reliable results over time.