⚡ ADXVMA Aurora Trend Filter combines ADX trend strength with an adaptive EMA blend to form a reliable trading baseline. Unlike ordinary indicators with fixed smoothing, Aurora adjusts in real time—closer to price in strong trends, smoother in ranges—and displays a clean Up / Down / Neutral bias with optional crossover arrows. The result is more responsiveness than static MAs and more stability than ADX alone.

- Adaptive baseline: blends fast & slow EMA using ADX as the weight.

- Three-state coloring: Blue (Up), Red (Down), Yellow (Neutral).

- Color Bars: candles tinted by current state.

- Arrows on price cross: modes By Trend (Classic) or All Crosses (Simple)

- Dashboard: live readout of periods, ADX and trend state.

- Bot-ready: hidden outputs TrendState (−1/0/+1) and ADX for cBots & scanners.

🆚 Why it’s stronger than ordinary indicators

- Versus fixed MAs: the adaptive coefficient reduces lag in trends and filters chop in ranges.

- Versus raw ADX: turns strength into a tradeable baseline (with colors & cross signals), not just a number.

- Versus generic filters: an ADX-weighted fast/slow EMA delivers a balanced mix of sensitivity and stability.

🧠 The engine: ADX-weighted EMA blend

ADX (0…100) measures trend strength. Aurora blends a fast and a slow EMA, using ADX as the weight:

- High ADX → bias toward fast (lower lag).

- Low ADX → bias toward slow (better noise filtering).

The line is color-coded by slope (and can be gated Neutral when ADX is weak), yielding a clean Blue / Red / Yellow read.

🎯 Perfect for:

- Scalpers, intraday and swing traders wanting a clear trend filter + simple triggers

- Algo traders needing stable, machine-readable series.

🧠 How the indicator works

ADX-weighted EMA blend. ADX (0…100) measures trend strength. Aurora blends a fast and a slow EMA using ADX as the weight:

- High ADX → shifts toward Fast → lower lag, closer to price.

- Low ADX → shifts toward Slow → smoother line, better noise filtering.

Color logic. The line is color-coded by its slope (optionally gated by ADX):

- Blue (Up): rising baseline, bullish context.

- Red (Down): falling baseline, bearish context.

- Yellow (Neutral): weak/sideways (small slope or ADX below threshold).

Signals. Arrows print on price crossing the baseline:

- By Trend shows only crosses aligned with the current color.

- All Crosses shows every cross.

🎯 How to Use in Trading

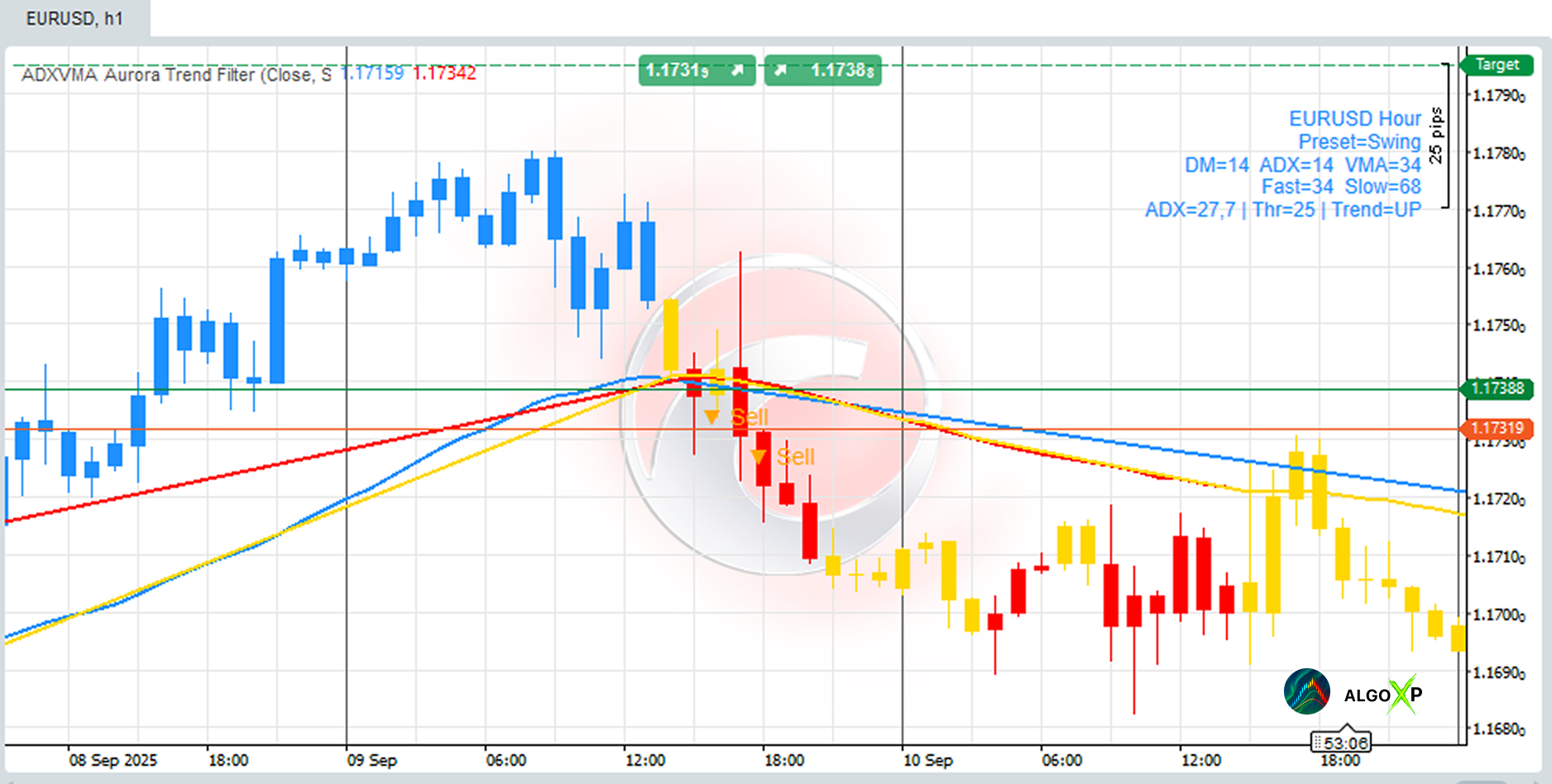

Trend Breakout (conservative)

- Take bias from color; set Arrow Mode = By Trend.

- Enter on the arrow with ADX ≥ threshold.

- Stop = Aurora line −/+ buffer (e.g., 8–15 pips on majors; adapt to symbol/TF).

- Exit at RR≥2, opposite cross, or color flip.

Pullback to Baseline (higher RR)

- Wait for a retracement into/near the Aurora line.

- Confirm with a bullish/bearish candle pattern in trend direction.

- Stop behind the pullback extreme or beyond Aurora ± buffer.

- Trail the stop by the Aurora line as the trend extends.

🕒 Timeframe notes

- Lower TFs (M1–M5): more signals & noise → consider higher ADX threshold and/or larger Neutral Slope.

- Higher TFs (H4–D1): steadier moves → classic ADX thresholds (~20–28) and moderate slope work well.

🛡️ Using Aurora as an adaptive stop

- Longs: stop below the Aurora line by a small buffer.

- Shorts: stop above the Aurora line by a small buffer.

For volatile markets, combine the buffer with a small ATR fraction to adapt to changing volatility.

🚀 Presets (start here, then refine)

- Scalp: VMA=12 · ADX=14 · ADX-Thr=28 · NeutralSlope=0.04 · Link=VMA→2×VMA

- Intraday: VMA=20 · ADX=14 · ADX-Thr=25 · NeutralSlope=0.06 · Link=VMA→2×VMA

- Swing: VMA=34 · ADX=14 · ADX-Thr=23 · NeutralSlope=0.10 · Link=VMA→2×VMA

- Position: VMA=55 · ADX=14 · ADX-Thr=20 · NeutralSlope=0.15 · Link=VMA→2×VMA

🤖 Integration for algo traders

Aurora exposes hidden, programmatic series:

- TrendState (−1/0/+1): Up / Neutral / Down regime.

- ADX: smoothed trend-strength value.

Use them in cBots for filters, entry/exit rules, and trailing logic aligned with the baseline.

ADXVMA Aurora Trend Filter

Source — price series to smooth (Close/Typical/Median).

Tip: Close is standard; Typical can slightly reduce noise.

Use genuine DM (Wilder) — strict +DM/−DM per Wilder.

Recommended: On for textbook ADX behaviour.

DM Period — smoothing length for TR and +DM/−DM.

Lower = faster DI/ADX, more noise; Higher = steadier trend strength.

ADX Period — smoothing for DX→ADX.

Lower = earlier trend-strength shifts; Higher = smoother/steadier ADX.

VMA Period — base speed of the Aurora line (adaptive MA).

Lower = closer to price (more signals); Higher = smoother (fewer, cleaner).

Adapt Link — how the adaptive blend is built:

- Link to VMA: Fast = VMA Period, Slow ≈ 2×VMA (classic).

- ManualFastSlow: set Fast EMA and Slow EMA yourself.

Fast EMA / Slow EMA (Manual mode only) — endpoints of adaptation.

Typical ranges: Fast 10–15, Slow 25–40.

Scale ADX Min / Max — maps ADX to 0…1 weight for blending Slow↔Fast.

Lower Min → reacts sooner; Higher Max → more conservative.

Neutral Slope (pips) — per-bar slope needed to paint Blue/Red.

Lower = more flips; Higher = more Yellow (range filter).

Flat if ADX < Threshold — force Neutral when ADX is weak (e.g., 20–28).

On = suppress chop; Off = pure slope coloring.

Arrow Mode — By Trend (Classic) = cleaner, fewer signals; All Crosses (Simple) = every cross, more management.Color Bars / Dashboard / Alerts — visuals & notifications; enable as needed.

FAQ – ADXVMA Aurora Trend Filter

An adaptive, ADX-weighted moving average that forms a trend baseline. It speeds up in strong trends and smooths out in ranges, painting Blue (Up) / Red (Down) / Yellow (Neutral) and printing crossover arrows for entries.

Aurora blends a fast EMA and a slow EMA using ADX (0–100) as the weight:

- High ADX → more Fast (lower lag, closer to price)

- Low ADX → more Slow (calmer, better noise filtering)

Blue (Up): rising baseline → bullish bias

Red (Down): falling baseline → bearish bias

Yellow (Neutral): weak/sideways (small slope or ADX < threshold)

Period: smoothing length of each EMA in the cascade.

Arrows appear when price closes across the Aurora line.

All Crosses (Simple): every cross (more signals, more management)

By Trend (Classic): arrows only in the current color’s direction (cleaner)

Bias: Above line + Blue → longs only; Below line + Red → shorts only; Yellow → stand aside

Entry: Take the arrow on a cross (preferably By Trend)

Exit: Stop at Aurora ± buffer; take profits at RR≥2 or on opposite cross / color flip

Scalp: VMA=12, ADX=14, Thr=28, NeutralSlope=0.04

Intraday (default): VMA=20, ADX=14, Thr=25, NeutralSlope=0.06

Swing: VMA=34, ADX=14, Thr=23, NeutralSlope=0.10

Position: VMA=55, ADX=14, Thr=20, NeutralSlope=0.15

Refine VMA (speed), Neutral Slope (color flips), ADX Threshold (chop filter).

Neutral Slope (pips): raises/lowers sensitivity of color changes per bar.

- Too many flips? Increase it. Missing early trends? Decrease it.

ADX Threshold: forces Neutral when ADX is weak (e.g., 20–28).

Too much Yellow? Lower it. Too many low-quality trends? Raise it.

They map ADX to the 0–1 weight that blends Slow↔Fast.

Higher Max → more conservative (smoother)

Defaults work well: Min=10 / Max=60.

Lower Min → reacts faster (earlier trend pickup)

Link to VMA (recommended): Fast = VMA, Slow ≈ 2×VMA. One knob (VMA) controls overall speed.

ManualFastSlow: set Fast/Slow explicitly for fine-grained tailoring (e.g., Fast 10–15, Slow 25–40).

All.

- Lower TF (M1–M5): more noise → consider higher ADX Thr and larger Neutral Slope

- Higher TF (H4–D1): steadier → classic ADX Thr 20–28 and moderate slope

Stop-loss: just beyond Aurora ± a small buffer (e.g., 8–15 pips on majors)

Take profit: RR≥2, or exit on opposite cross / color flip

Trailing: trail by Aurora ± buffer; for volatility, add a small ATR fraction

Increase VMA Period (smoother baseline)

Increase Neutral Slope (fewer flips)

Raise ADX Threshold (filter weak trends)

Use By Trend arrows (skip counter-color crosses)

ADX is likely below your Threshold or slope is too small. Fixes:

Reduce VMA slightly for more responsiveness

Lower ADX Threshold;

or

Lower Neutral Slope;

or

Reduce VMA slightly for more responsiveness

No. It uses only past and current bar data. The current bar can update until it closes (normal real-time behavior), but closed bars do not change.

Yes. The indicator exposes:

ADX: smoothed trend-strength value

Use them as filters (e.g., TrendState == +1 for long-only), entry/exit conditions on crosses, and for adaptive trailing around the baseline.

TrendState (−1/0/+1): Up/Neutral/Down regime