Definition:

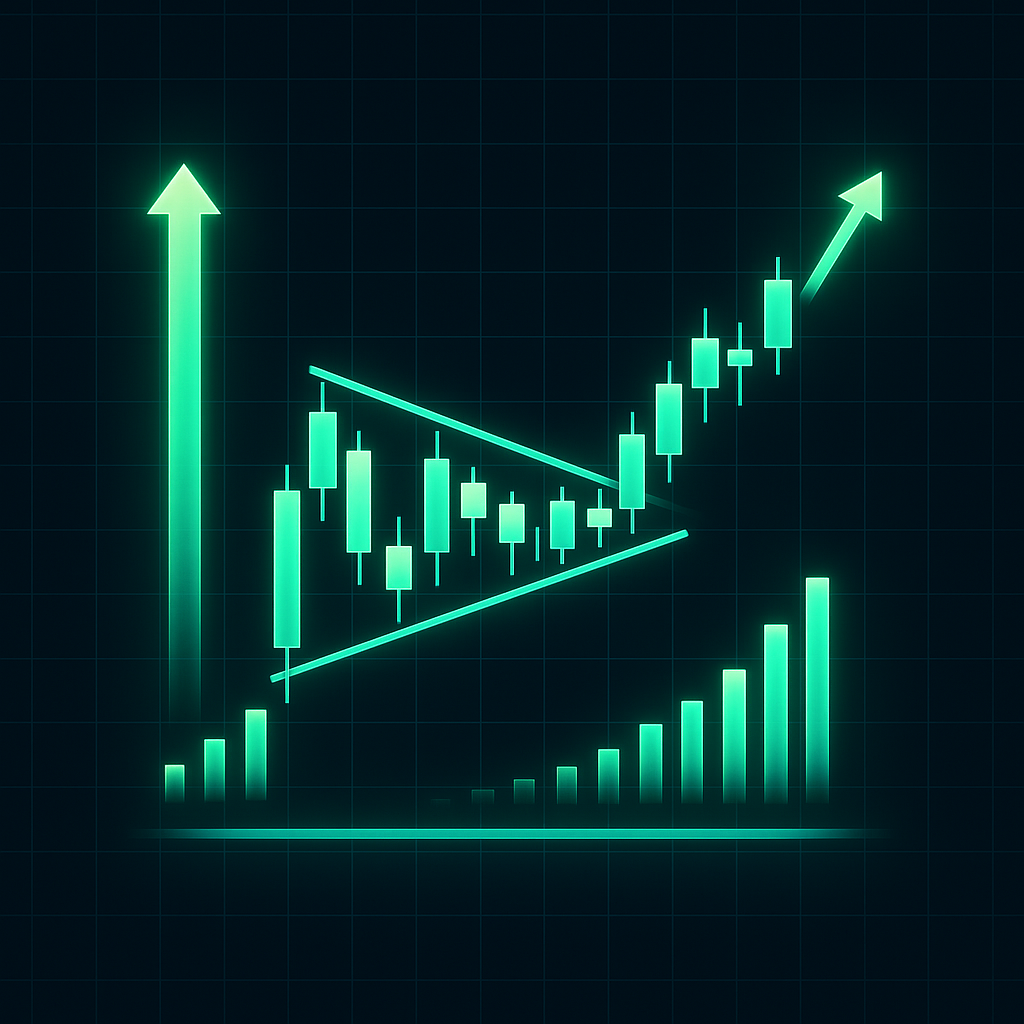

A Bullish Flag forms after a strong upward impulse, when the price enters a short consolidation, usually in the form of a downward-sloping channel. This pause reflects the market “catching its breath” before continuing higher.

Key Characteristics:

- Strong upward impulse (the flagpole).

- A corrective channel sloping downward.

- Decreasing volume during the correction phase.

- Breakout to the upside accompanied by increasing volume.

How to Trade:

Traders and algorithms enter long positions on the breakout of the flag’s upper boundary. Stop-loss is placed below the local minimum of the channel, while the target is measured by the height of the flagpole.

Common Mistakes:

- Entering before a confirmed breakout.

- Ignoring volume (false breakouts occur frequently).

Conclusion:

This is one of the most reliable continuation patterns, especially in trending markets such as gold and major currencies.