Genetic Algorithms in Trading Optimization

Traditional optimization tests every possible parameter combination, but this can be extremely slow and inefficient. For complex strategies with many…

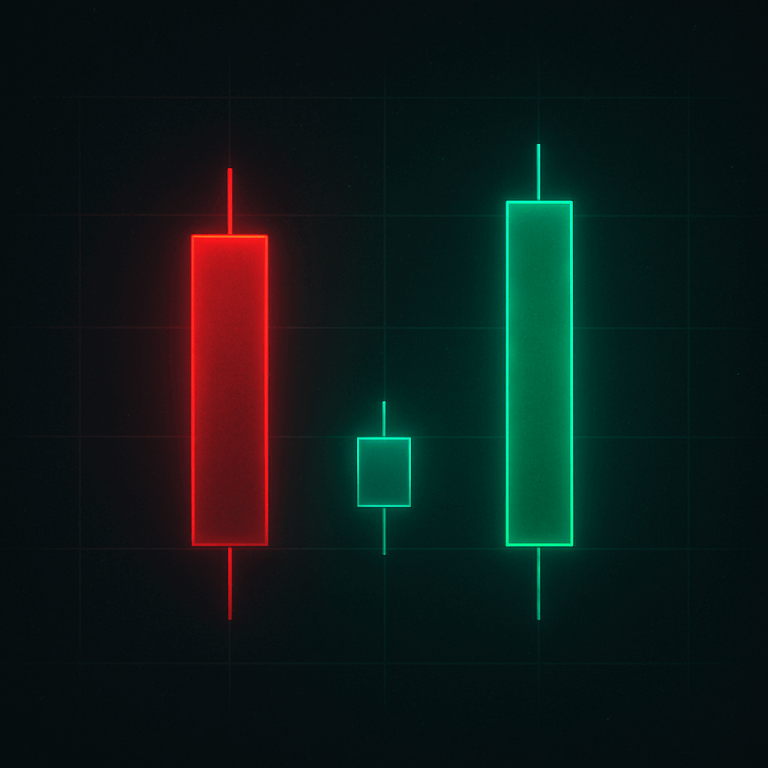

Morning Star / Evening Star

Pattern Type: Reversal (bullish / bearish) Definition:A three-candle reversal formation. Morning Star appears at the bottom; Evening Star at the…

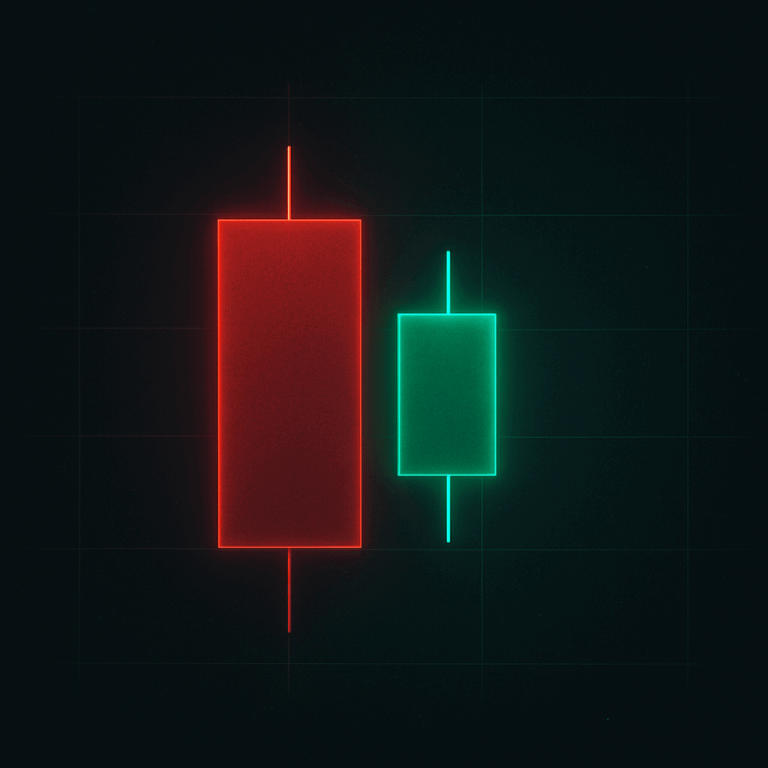

Harami

Pattern Type: Reversal (bullish or bearish) Definition:A two-candle pattern where the second candle’s body is completely within the range of…

Hanging Man

Pattern Type: Reversal (bearish) Definition:The bearish counterpart of the hammer, appearing at the top of an uptrend. It signals weakness…

Doji

Pattern Type: Neutral (pause / possible reversal) Definition:A candle with no real body or an extremely small one. It signals…

Hammer

Pattern Type: Reversal (bullish) Definition:A reversal candlestick that forms after a decline. The candle has a small body near the…

Cup and Handle

Group: Trend Continuation Definition:A long-term accumulation pattern: a rounded bottom (cup) followed by a short correction (handle), ending with an…

Rectangle / Range

Group: Trend Continuation Definition:A sideways consolidation after an impulse move, where the market builds energy before the next breakout. Key…

Symmetrical Triangle

Group: Trend Continuation Definition:A consolidation pattern of uncertainty, where both highs and lows contract. The breakout often follows the direction…