JPY Samurai Breakout Lite — Simple Breakout Indicator for cTrader ⚔️

A lightweight version of the breakout indicator designed for traders who want simplicity and speed.

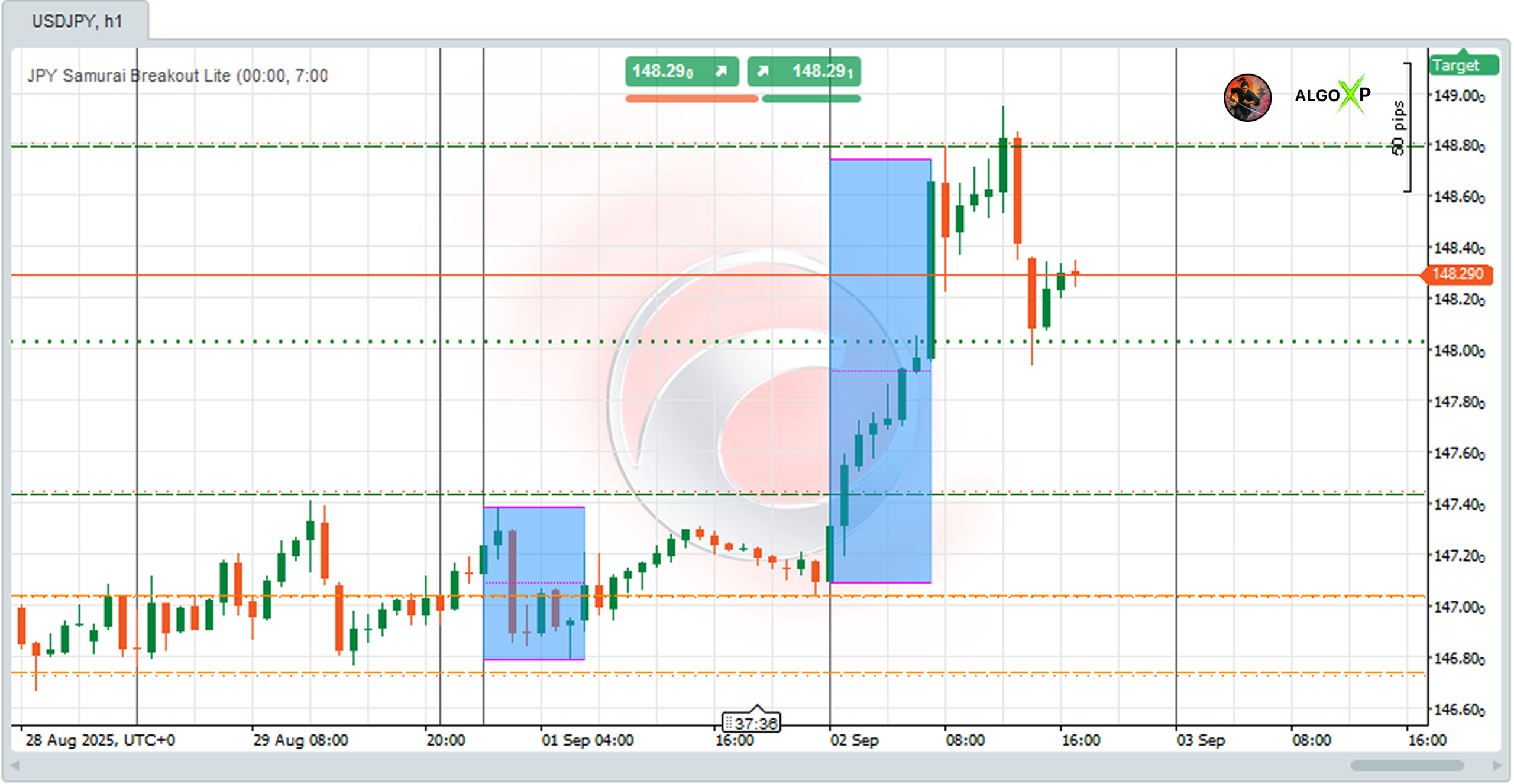

JPY Samurai Breakout Lite automatically plots the Asian session range and shows clear breakout levels (Buy/Sell, SL, TP) — without extra features or statistics.

✅ Main Features:

- Automatic Asian session Box with High/Low levels.

- Optional Mid-line for visual balance.

- Buy/Sell breakout levels with Stop Loss and Take Profit.

- Multi-day history view (default: 3 days).

- Semi-transparent box fill for better visual clarity.

- Predefined color themes: Dark and Light .

🎯 Perfect for:

- Traders who want a clean chart setup.

- Scalpers and intraday traders on JPY pairs (USDJPY, GBPJPY, EURJPY, AUDJPY).

- Beginners who want to test breakout strategies visually.

⚡ Why Lite?

- Just breakout levels, clean and ready.

- No statistics, no complexity.

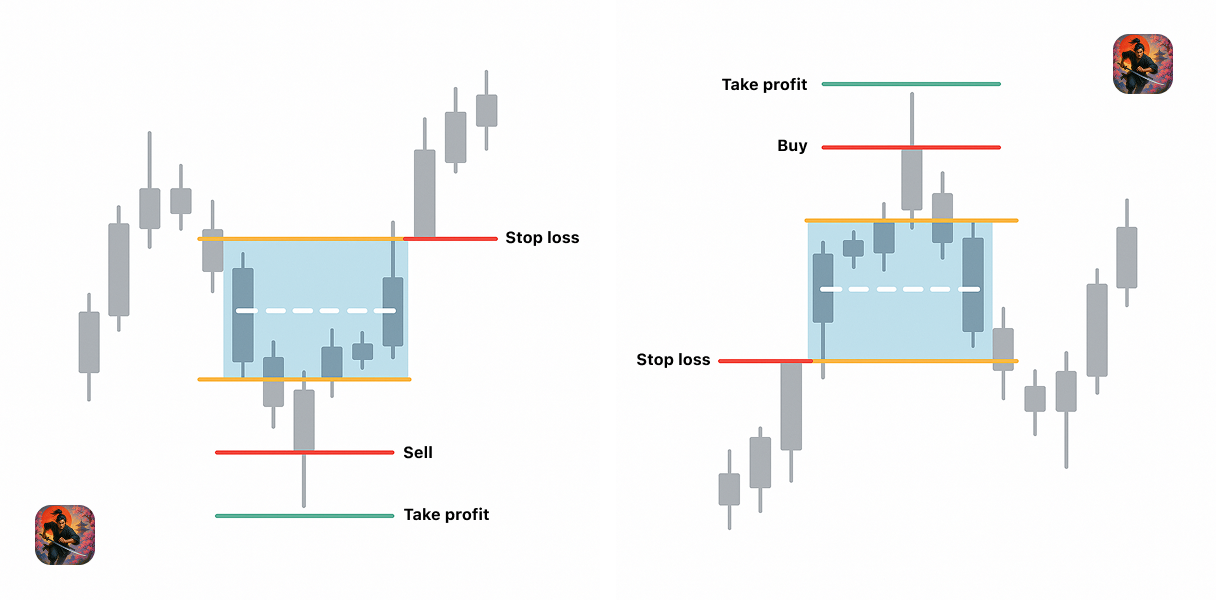

How to Use

Take Profit = Box size × Multiplier.

Apply on JPY pairs (USDJPY, GBPJPY, EURJPY, AUDJPY).

Wait until Asian session ends → Box is drawn.

Watch for price breakout:

Above Buy Entry → Long setup.

Below Sell Entry → Short setup.

Stop Loss = opposite side of Box.

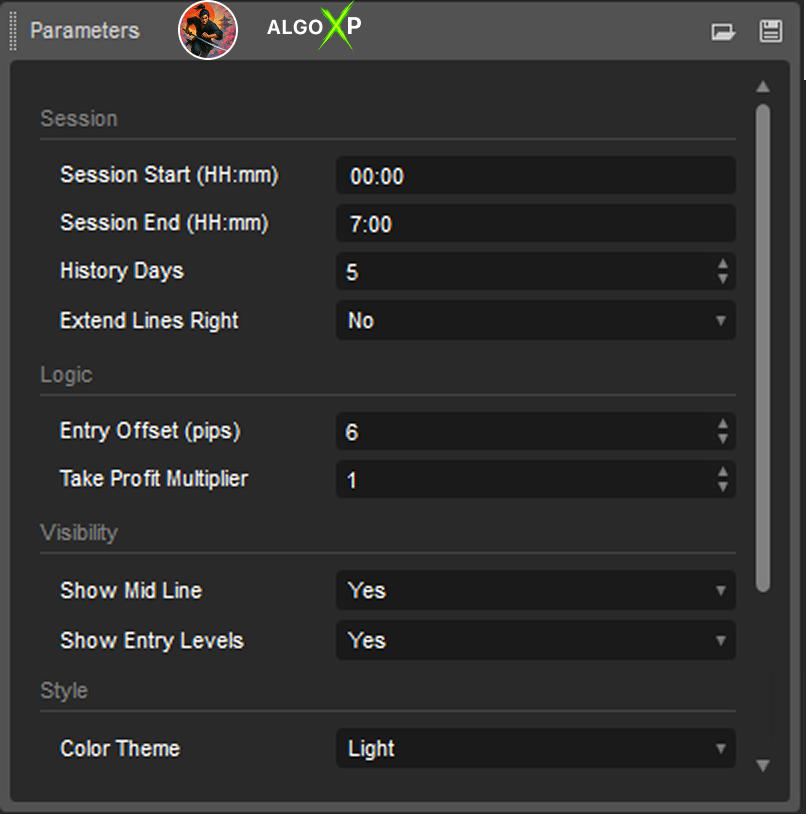

JPY Samurai Breakout Lite – Parameters Overview

Session Parameters

Session Start / End

Defines the time window used to build the Asian session breakout box.

- Default: 00:00–07:00 UTC.

- All price action between these times is scanned to determine the session High and Low.

- These levels form the breakout range for the trading day.

- Adjusting this window changes the box size and placement — for example, some traders prefer Tokyo-only hours, others include Sydney.

History Days

Sets how many previous days are analyzed and drawn.

- Default: 5.

- Each day’s box is drawn separately, allowing you to visually compare past breakouts.

- The statistics panel (Wins, Losses, Avg Range, Win Rate) also uses this value to calculate averages and success rate.

- Larger values (20–30) show long-term tendencies; smaller values (3–5) focus on recent market behavior.

Extend Lines Right

Controls whether the High, Low, and Mid lines extend beyond the session window.

- Enabled (true): levels are projected across the entire trading day, making them usable for entries even after the session closes.

- Disabled (false): levels stop at the end of the Asian session.

Logic Parameters

Entry Offset (pips)

Offsets breakout entry levels above the session High and below the session Low.

- Purpose: filters out minor wicks and false breakouts.

- Example: If High = 150.00, Entry Offset = 5 → Buy entry = 150.05.

- Larger offsets reduce false signals but may miss smaller breakouts. Recommended range: 2–5 pips.

Take Profit Multiplier

Determines the distance of Take Profit targets relative to the box size.

- Formula: TP = Box Range × Multiplier.

- Example: Box = 25 pips, Multiplier = 2.0 → TP = 50 pips from entry.

- Larger multipliers aim for extended runs; smaller multipliers lock in quicker profits.

Stop Loss Placement

Stop Loss is automatically placed beyond the box, slightly offset to avoid overlap with entry levels.

- Current build: SL = opposite side of box ±1 pip.

- Even if Entry Offset = 0, SL will still be displaced, ensuring chart clarity.

- Note: offset is fixed in this version, not a user parameter.

Min / Max Range (pips)

Filters out invalid Asian session boxes.

- If the box size is too narrow (< Min) → breakout ignored (range considered noise).

- If the box size is too wide (> Max) → breakout ignored (range considered untradeable).

- Example: Min = 20, Max = 80.

- A 10-pip range will be skipped (too small).

- A 150-pip range will be skipped (too large).

- Helps avoid unrealistic or low-probability breakouts.

Visibility Parameters

Show Mid Line

Toggles the display of the midpoint between High and Low.

- Useful for visual balance and sometimes as an intraday support/resistance reference.

- Not required for entries.

Show Entry Levels

Enables drawing of Buy/Sell entries with corresponding SL and TP levels.

- On: full breakout strategy shown (Box + Entry + SL + TP).

- Off: only the session box is displayed, for traders who want to analyze range without execution levels.

Color & Style Parameters

Color Theme

Selects overall color style: Dark, Light, or Custom.

- Dark/Light: predefined color sets

FAQ – JPY Samurai Breakout Lite

It’s a simplified breakout tool that marks the Asian session range and plots entry, stop loss, and take profit levels.

Mainly JPY pairs: USDJPY, GBPJPY, EURJPY, AUDJPY.

Because it includes only the essential features — no statistics, no complex filters, nocolor customization, just a clean breakout setup.

If need more – try Pro version

Best on M15 to H1. Smaller timeframes may show too much noise.

Set Buy Stop slightly above the Box (Buy Entry) and Sell Stop slightly below (Sell Entry). SL and TP are auto-calculated.

The Pro version has detailed statistics (Wins, Losses, WinRate), advanced customization, and analysis. Lite version is minimal — just Box + breakout levels.