Lisa EURUSD Breakout is a purpose-built cTrader robot for EURUSD that trades a classic session box breakout with disciplined risk controls.

It builds a high/low box over a chosen trading window (Tokyo / London / New York / Overlap or Custom) and places exactly one pending order per side after the session closes.

The approach is inspired by the Samurai Breakout Pro II methodology, adapted for automated entries and modern risk management.

⚙️ What You Configure

- Session: preset or custom times (UTC/offset), cancel-after hours.

- Breakout: entry offset, min/max range, max spread, allowed side (Both/Buy only/Sell only).

- SL/TP: mode + single contextual value (as above).

- Volume: fixed lot.

- Order/Position: expiry, OCO, trailing, partials, visualization.

🧭 Why Lisa?

- Clear, classical breakout logic (no grids, no martingale).

- Session-first design: what you see in the box is what the bot trades.

- Built on Samurai Pro 2 methodology for box formation & breakout discipline.

🔧 Best Use

- Run on a consistent timeframe (e.g., M5–M30) that matches your session definition.

- Start with conservative SL/TP (e.g., SL: Fixed 10 pips, TP: Fixed 40 pips or RR 1:2–1:3), then iterate.

🛡️ Key built-in risk controls include:

- Daily stop-loss limits and floating drawdown protection

- Free margin and volume safeguards

Lisa EURUSD Breakout is ideal for traders who want a transparent, session-driven breakout system with simple SL/TP logic and sensible guardrails—without grids or martingale.

Lisa EURUSD Breakout offers a wide range of parameters grouped into logical sections for easier setup.

🧭 Why Traders Like Lisa

Robust session handling—presets + Custom with correct UTC offset conversion.

Pure breakout logic—no grids or martingale.

Equity & margin protection—helps avoid margin stress and deep drawdowns.

Transparent controls—one SL mode + one TP mode at a time, no parameter spaghetti.

Lisa EURUSD Breakout – Parameters Overview

Session

- Session Preset (

Tokyo / London / NewYork / Overlap_LondonNY / Custom)

Determines the time window used to build the box. - Session Start / Session End (HH:mm)

Start/end of the box window in the selected time base. Applies when Custom (or to override). - Session Time Base (

UTC / CustomOffset)

Defines how Start/End are interpreted. With CustomOffset, an offset to UTC is applied. - Custom Offset (UTC±H)

Offset in hours relative to UTC (e.g.,3for UTC+3). Internally, time is converted to UTC as(local − offset).

Tip: Use London for a clean European session. For local hours, switch to CustomOffset and set your UTC shift.

Breakout

- Entry Offset (pips)

Extra pips added beyond the box high/low to reduce false breaks (typical 2–5 pips on EURUSD). - Min Range (pips) / Max Range (pips)

Acceptable box size. Days outside this range are skipped (helps avoid noise/abnormal days). - Max Spread (pips)

Maximum tolerated spread at order placement time (e.g., 1.0–2.5 for EURUSD). - Side Mode (

Both / OnlyBuy / OnlySell)

Which sides are allowed for the breakout.

SL/TP (Unified Interface)

- SL Mode (

Box / FixedPips)- Box: SL at the opposite box boundary + ~1 pip buffer.

- FixedPips: constant SL distance from entry in pips.

- SL Value (contextual)

Used when FixedPips (e.g., 12–20 pips). Ignored in Box mode. - TP Mode (

RR / FixedPips / BoxMultiple)- RR: TP =

TpValue × SL. - FixedPips: TP is a fixed pip distance.

- BoxMultiple: TP =

TpValue × box size.

- RR: TP =

- TP Value (contextual)

Multiplier or pips depending on TP mode: RR (multiplier), FixedPips (pips), BoxMultiple (box multiplier).

Starter suggestion: SL = FixedPips (15) and TP = RR (1.5).

Prefer geometry? Use SL = Box and TP = BoxMultiple (0.8–1.2).

Volume

- Fixed Lot (lots)

Order size. Ensure it passes the margin after order check (see Risk).

Order management

- Order Expiry (hours)

Per-order lifetime. If not triggered in time, the pending order expires automatically. - Cancel After (h) from SessionEnd

Post-session cleanup: N hours after the session end, cancel all remaining pendings and end the trading day.

Different from Order Expiry (per-order timer) — this is a session-based global broom. - Cancel Opposite On Fill

OCO behavior: when one side fills, cancel the opposite side.

Position management

- Enable Trailing / Trail Trigger (pips) / Trail Step (pips)

Enables trailing stop with activation distance and step. - Enable Partial Close / Partial @ +pips / Partial %

Partial exit once profit reaches the specified pips (e.g., close 51% at +17 pips).

Risk management

- Max Daily Floating DD (%)

Daily floating drawdown guard: ifEquityvsBalancedrops below −N%, flatten all bot positions and pendings for the day. - Min Free Margin After Order (%)

Pre-placement what-if margin check, as if the pending order had already filled. If free margin after < N%, block placement. - Stop cBot Equity DD from Start (%)

Equity circuit breaker: ifEquity ≤ StartEquity × (1 − N%), flatten everything and latch the bot (no more trading until restart).

Visuals

Show Visuals

Draws the session box and Entry/SL/TP levels—very useful for verification.

FAQ – Lisa EURUSD Breakout

EURUSD only. The bot hard-stops if attached to a different symbol.

After the chosen session window closes (box finalized) and all filters pass (spread, box size, margin).

At most one per side (buy/sell). With OCO enabled, the opposite pending is canceled on fill.

Order Expiry = per-order lifetime.

Cancel After = session-level broom N hours after SessionEnd (cancels all remaining pendings and ends the day).

SL=Box: opposite box boundary + small buffer.

SL=FixedPips: constant distance.

TP=RR: SL × multiplier.

TP=FixedPips: constant pips.

TP=BoxMultiple: box size × multiplier.

Possible reasons: Partial took some profit, Trailing moved SL and got hit, slippage, or price not available for exact fill.

Simulates margin as if the pending was already filled; blocks placement if free margin after < threshold.

If Equity vs Balance drawdown ≤ −N%, the bot flattens positions/pendings and stops trading for the rest of the day.

A hard equity breaker from the bot’s start equity. If hit, the bot flattens and latches (requires manual restart).

Choose Session Time Base = CustomOffset and set Custom Offset (e.g., 3 for UTC+3). Enter Start/End in your local hours.

Box size outside Min/Max Range, spread > Max Spread, or insufficient margin after the what-if check.

Yes – set Side Mode to OnlyBuy or OnlySell.

More noise/false breaks ⇒ larger offset. On EURUSD, 2–5 pips is a good starting point.

Backtest (tick), start with small lots and conservative risk (DD 20–35%, RR 1.2–1.5). Mind your broker’s spread/commission.

The session rectangle (time/high/low) and horizontal lines for Entry/SL/TP—great for sanity checks.

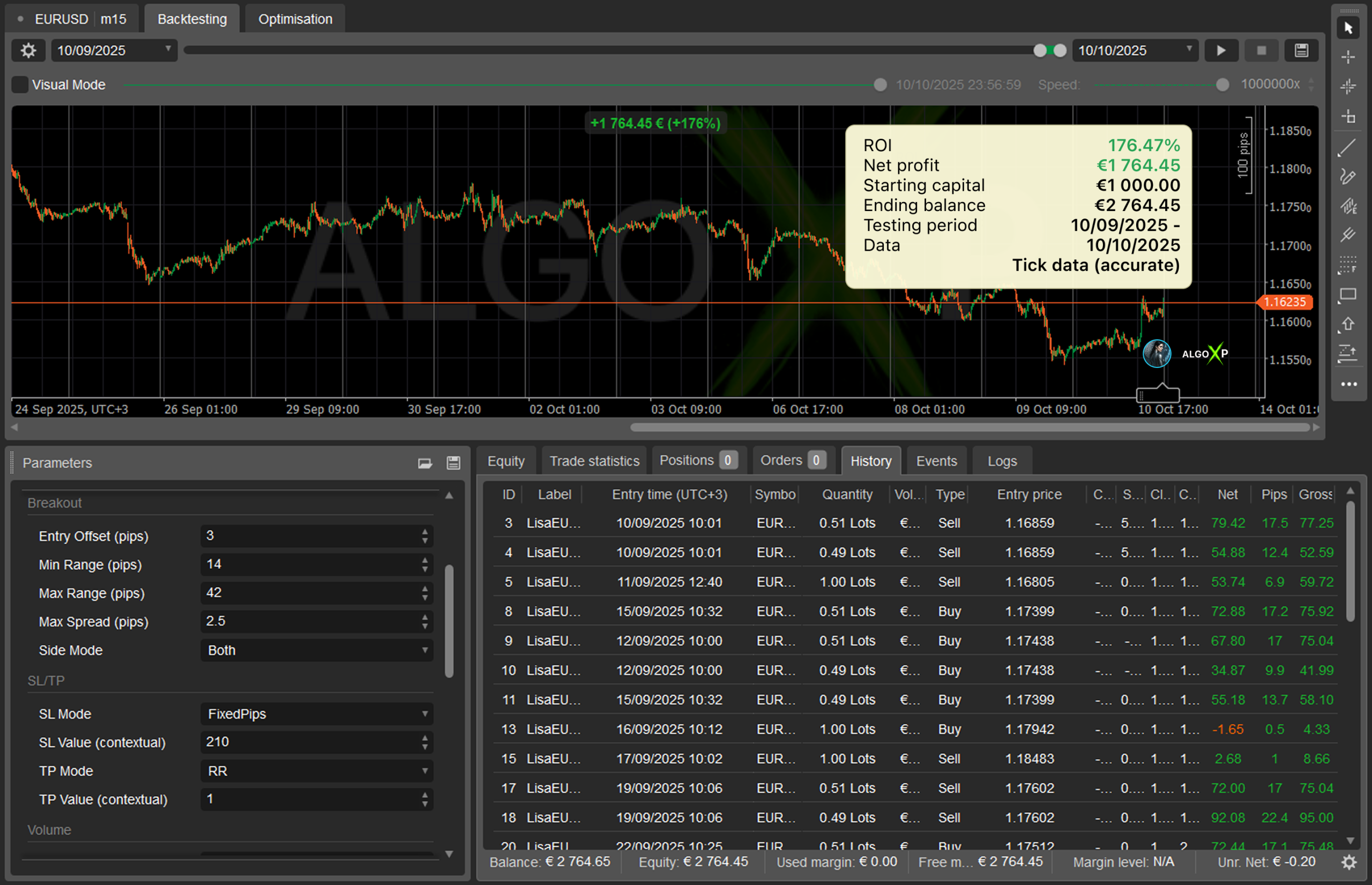

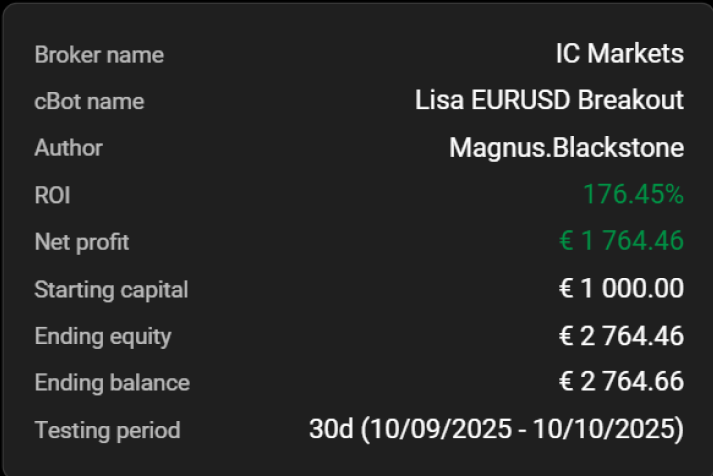

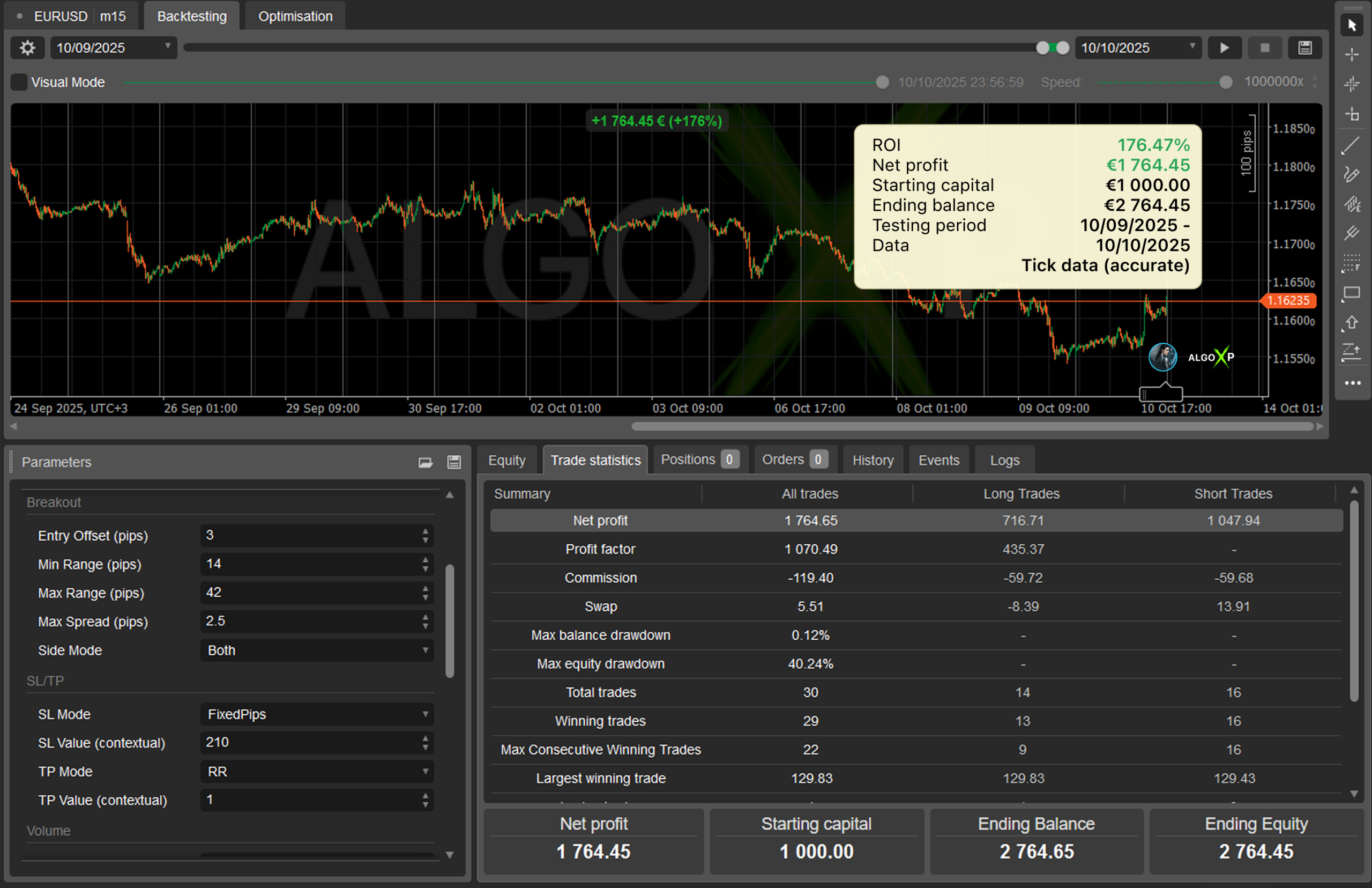

Backtesting on Ticks for 1 months 10/09/2025 -10/10/2025

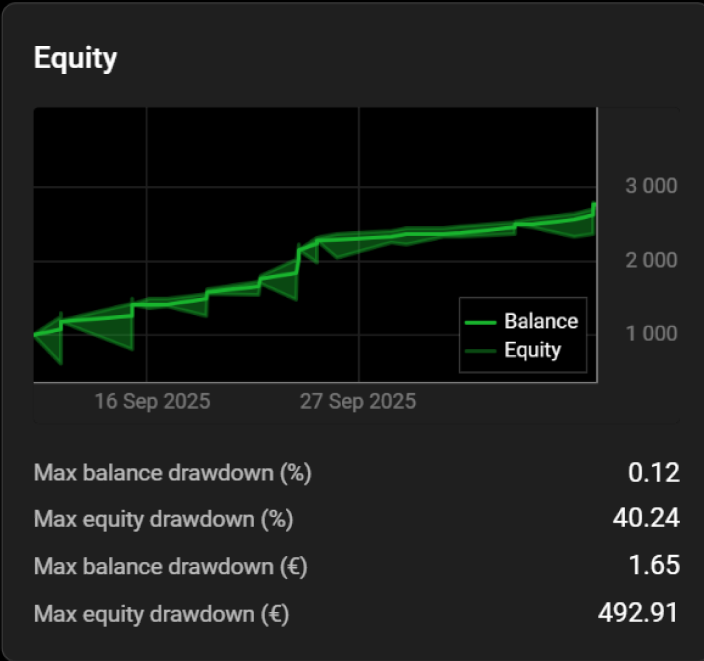

Equity

Trade statistics

History