⚡ Meridian Pivot Points Pro is a premium pivot indicator for cTrader that adapts to sessions and timeframes. It plots professional-grade pivot levels (P, R1–R5, S1–S5) for Standard, Fibonacci, Woodie, Camarilla, and DeMark formulas, adds mid-levels, and highlights zones (green below P, red above P) with adjustable transparency.

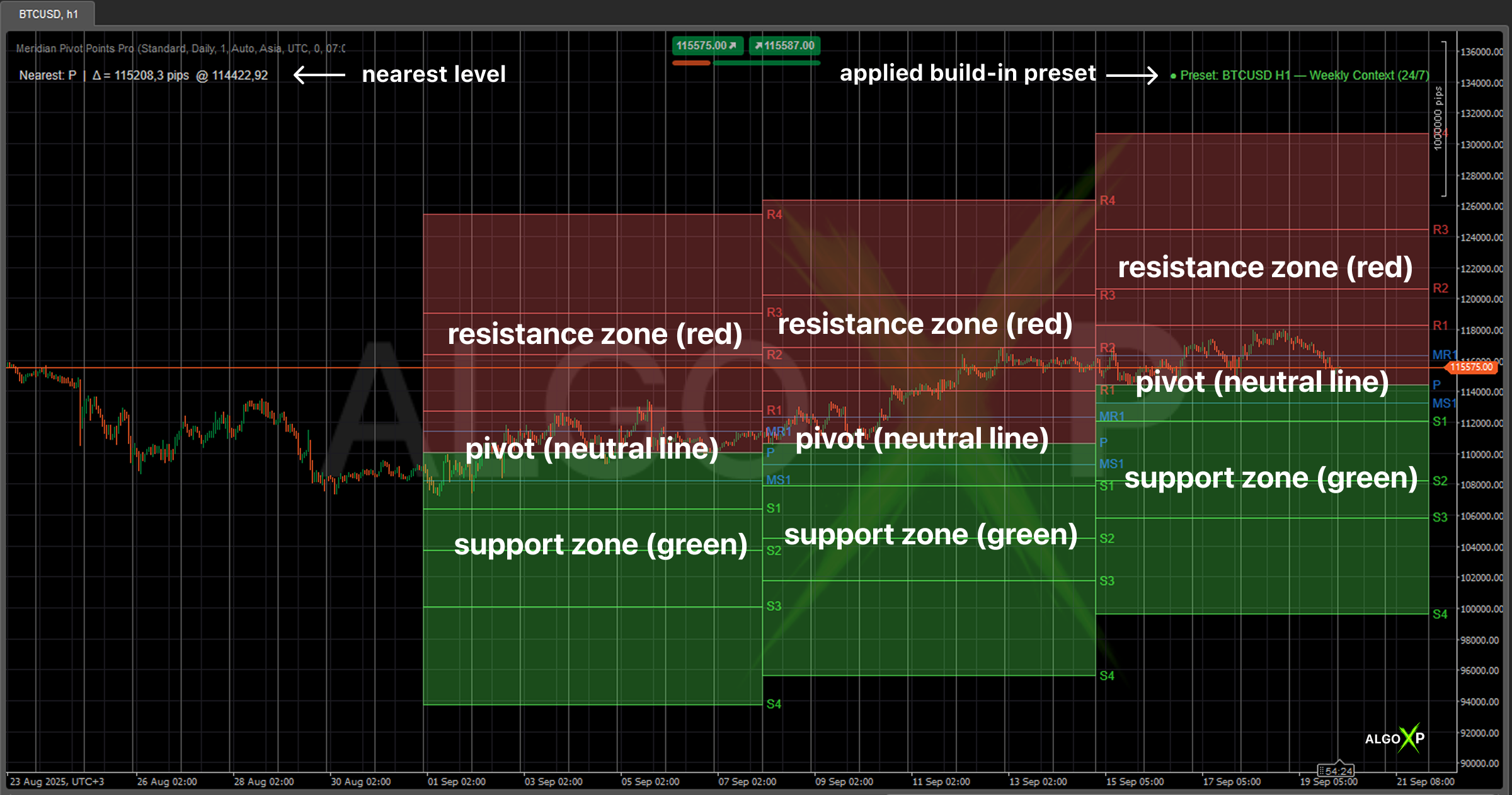

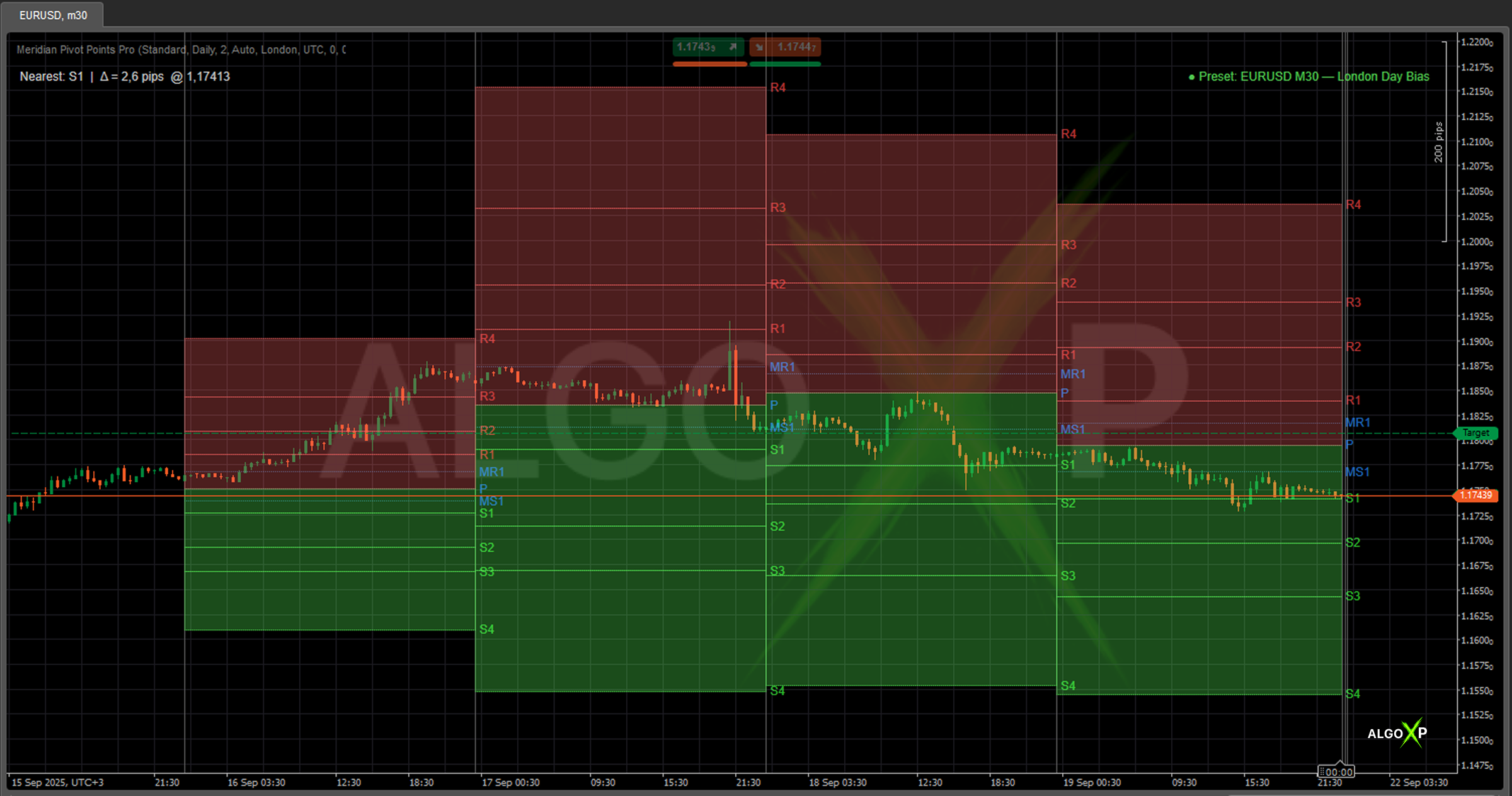

The built-in Auto Presets instantly tune settings for popular symbols and timeframes. The HUD shows the nearest level (with distance in pips) and the active preset name when matched. Smart alerts notify on level cross or proximity—with independent sound controls.

Works out-of-the-box for Forex, indices, gold, oil, and crypto across intraday and swing trading.

🆚 What makes it different

- Session-aware: use daily/weekly/monthly pivots or a Session mode with ready-made presets (Tokyo, London, New York, Overlap, etc.) and UTC/Broker/Custom offset.

- Auto Presets (new): when enabled, the indicator auto-applies a curated setup for known symbol + timeframe combos and shows the preset name in the HUD.

- Clarity by design: mid-levels, labels, clean themes, and semi-transparent bands (supports green, resistances red, pivot blue).

- Actionable alerts: cross on candle close and proximity in pips, each with its own sound toggle.

- Lightweight & readable: optimized to draw current and (optionally) historical periods with crisp typography.

🎯 Perfect for

- Intraday traders (FX, indices, gold, oil, crypto): clean, session-aligned zones for entries and exits.

- Scalpers: nearest levels + mid-levels for quick retests; Proximity alerts for timely execution.

- Swing traders: weekly/monthly pivots for higher-timeframe context and targets.

- Strategy planners & prop traders: objective targets, stop logic “beyond the level,” and disciplined position management.

- Newer traders: Auto Presets and color-coded zones make pivots intuitive from day one.

- Power users (TV/MT/NT alumni): familiar pivot logic with a refined cTrader implementation and session awareness.

🧠 How the indicator works

Meridian Pivot Points Pro reads the market’s most recent completed window—day/week/month or a chosen trading session—and derives a central reference with a ladder of support/resistance bands around it. You can switch between several professional methodologies (e.g., floor-trader, Fibonacci-style, volatility-aware variants) to match your playbook.

The tool then projects that structure onto the current window, making it session-aware (Tokyo/London/NY/overlap timing, broker/UTC/custom offset). Bands are color-coded for quick bias recognition, optional mid-zones help with pullbacks, and the HUD surfaces the nearest actionable level with distance.

Auto Presets recognize common symbol + timeframe pairs and load tuned visuals/parameters, while alerts react to meaningful interactions with the structure (confirmed breaks and close approaches) without cluttering the chart.

🚀 Presets

Auto Presets trigger automatically (if Preset mode is choisen Auto) when a symbol + timeframe pair is recognized and the preset name is shown in the HUD.

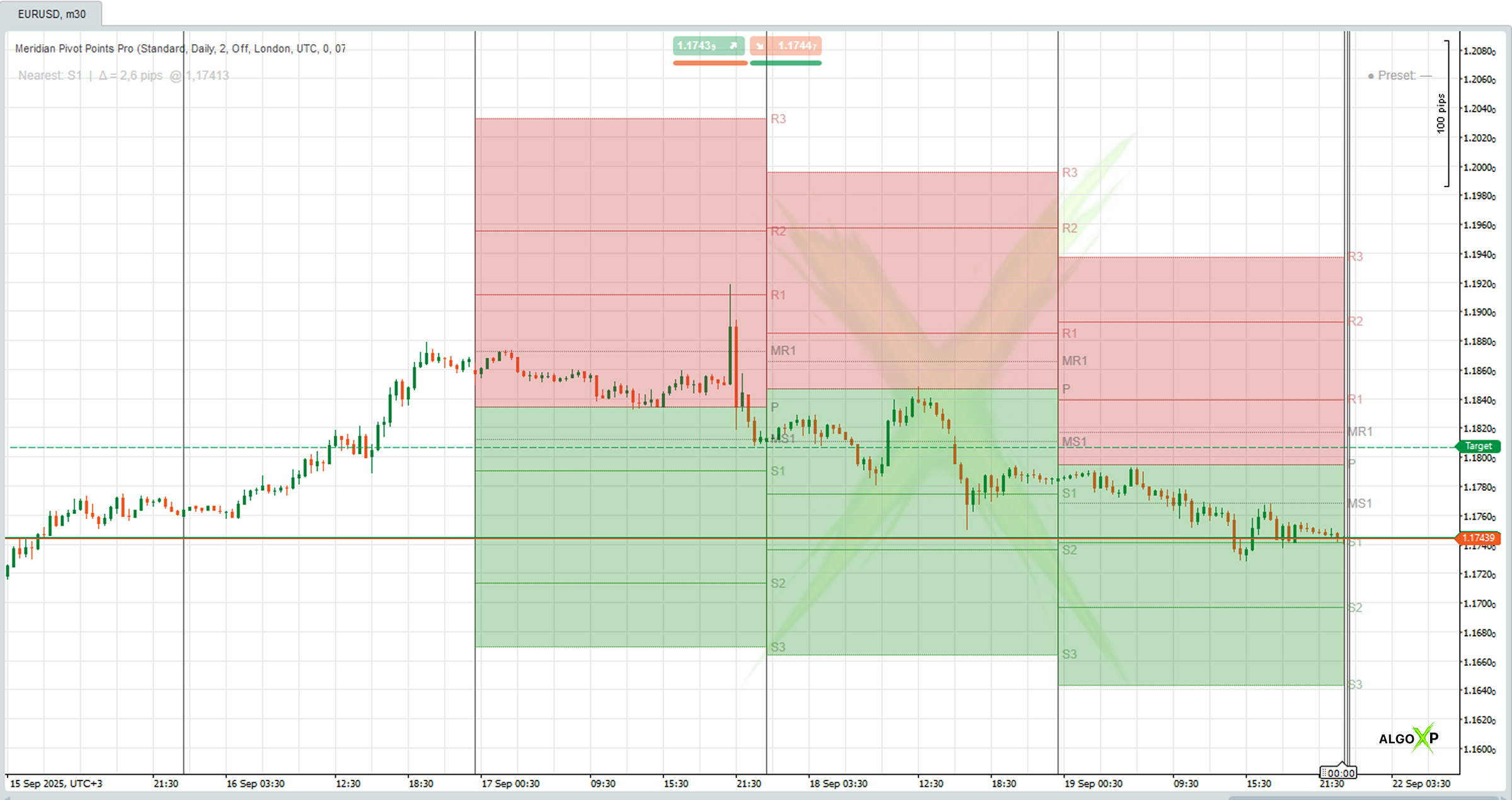

EURUSD M30 — London Day Bias

Daily • Standard • R/S=4 • Mid=On • London (UTC) • Lookback=3

GBPUSD M15 — London Momentum

Daily • Standard • R/S=4 • Mid=On • London (UTC) • Lookback=4

USDJPY M5 — Tokyo Scalper

Daily • Standard • R/S=3 • Mid=On • Tokyo (UTC) • Lookback=2

XAUUSD M15 — London–NY Overlap

Daily • Fibonacci • R/S=5 • Mid=Off • Overlap (UTC) • Lookback=5

XAUUSD H1 — Swing Day

Daily • Standard • R/S=4 • Mid=On • London (UTC) • Lookback=7

US100 M5 — US Open

Daily • Standard • R/S=4 • Mid=On • US (UTC) • Lookback=3

USOIL M15 — NY Energy

Daily • Standard • R/S=4 • Mid=Off • US (UTC) • Lookback=4

DAX40 M5 — Europe Open

Daily • Standard • R/S=4 • Mid=On • Europe (UTC) • Lookback=3

Weekly / 24/7 Context

BTCUSD H1 — Weekly Context (24/7)

Weekly • Standard • R/S=4 • Mid=On • FullWeek • US (UTC) • Lookback=2

ETHUSD H1 — Weekly 24/7

Weekly • Standard • R/S=4 • Mid=On • FullWeek • US (UTC) • Lookback=2

EURUSD H1 — Weekly Swing

Weekly • Standard • R/S=4 • Mid=Off • London (UTC) • Lookback=3

GBPJPY M15 — Volatility Focus

Daily • Fibonacci • R/S=5 • Mid=Off • London (UTC) • Lookback=4

Meridian Pivot Points Pro – Parameters

Core

- Pivot Type — Standard / Fibonacci / Woodie / Camarilla / DeMark.

Chooses how levels are calculated. - Period Mode — Daily / Weekly / Monthly / Session.

Which period the pivots are based on. - Lookback Periods — 0–50.

How many previous periods to draw when Show History is on. - Preset Mode — Off / Auto.

If Auto, the indicator automatically applies a matching preset when it detects a supported symbol + timeframe and updates on timeframe changes. (Auto presets never change your alert sound toggles and color theme.)

Sessions (used when Period Mode = Session)

- Session Preset — Tokyo / London / NewYork / LondonNYOverlap / Asia / Europe / US / Custom.

Sets the session start & default length (you can override the length). - Session Timezone — Broker / UTC / CustomOffset.

Defines how session time aligns to your chart. - Custom TZ Offset (min) — shift minutes if CustomOffset is selected.

- Custom Start (HH:MM) — only for Custom session preset.

- Session Length (min) — duration of each session window.

- Active Days — Weekdays / FullWeek.

Include weekends for 24/7 markets like crypto.

Levels

- Max R/S Levels — 1–5.

How many R/S levels to show above/below P. - Mid-Levels (P↔R1 / S1↔P) — On/Off.

Adds MR1 and MS1. - Show History — On/Off.

Draws previous periods/sessions applied to the next period’s price action. - Labels — None / Left / Right.

Side for level labels (R1, S1, MR1, etc.).

Visual

- Theme — Clean / DarkNeon / LightPro.

Color presets (P=blue, R=red, S=green) tuned for white or dark charts. - Opacity (Lines) — Low / Medium / High.

Transparency for lines & labels. - Line Thickness — 1–5.

- Line Style — Solid / Dots / etc.

- Fill Zones — On/Off.

Paints bands: green below P, red above P. - Fill Opacity — Low / Medium / High.

Transparency for the bands (lighter by default to keep charts clean). - Show HUD (Nearest Level) — On/Off.

Shows nearest level with distance in pips and the active preset name (if matched).

Alerts

- Alert on Cross (Close) — On/Off.

Fires when a candle closes across a pivot line. - Enable Proximity Alert — On/Off.

Monitors distance to levels in real-time. - Proximity (pips) — the distance threshold.

- Sound on Cross — On/Off.

- Sound on Proximity — On/Off.

Auto presets never flip these sound options—you control them

📘 Trading Playbook

🔥 Core framework

Set context: choose Daily / Weekly / Monthly or Session. Intraday → Daily/Session; swing → Weekly/Monthly.

Market axis: P (Pivot) is neutral. 🎚️

Above P → buyer tilt. 🟢

Below P → seller tilt. 🔴

Targets & “stop zones”: R levels = supply/targets; S levels = demand/targets. Bands help plan partials and risk.

🚀 Go-to setups

A. Revert-to-P (mean reversion)

Flat/balanced conditions.

Buy from S1/S-zone → P (or sell from R1/R-zone → P).

Scale at MR1/MS1, main target P.

B. Intraday trend

Directional move from session open.

Above P: buy from S-zones / MS1 / P toward R1 → R2. 🟢

Below P: sell from R-zones / MR1 / P toward S1 → S2. 🔻

Add on mid-level retests; trail behind the opposite band.

C. Break & hold

Close beyond R1/S1 (Cross on Close alert).

Target next step (R2/S2, then R3/S3…).

Avoid entries right around high-impact news; best quality in London and London–NY overlap.

D. Extremes fade

Volatility at R3/R4 or S3/S4.

Small countertrend back to nearest mid/weak zone.

Use smaller size, tight invalidation beyond the level.

⏱️ Session-Aware best practices

Pick a session preset (Tokyo, London, NY, Overlap) and correct TZ (UTC/Broker/Custom).

Trade inside the active window for cleaner touches and follow-through.

Especially effective for FX majors, XAUUSD, and indices.

🔍 Multi-timeframe flow

HTF (H1/H4/D1): use Weekly/Monthly pivots for big “walls” and roadmaps.

LTF (M5–M30): execute on Daily/Session, confirm direction vs. HTF P.

🔔 Alerts workflow

Proximity: early heads-up — prepare, don’t chase.

Cross on Close: confirmation — often the trigger for continuation.

Keep sound only for signals you truly act on.

🛡️ Trade management

Stops: beyond the nearest invalidation level/zone (behind R if short, behind S if long).

Partials: at mid-levels and first targets (R1/S1).

Trail: step behind each passed band/level to lock progress.

🧰 Instrument tips

FX majors: Daily + Session (London/Overlap).

Gold (XAUUSD): Daily/Session; Weekly for swings.

Indices (US100, DAX): matching session + Weekly context.

Oil (USOIL): US/Overlap sessions; mind news windows.

Crypto: Weekly/Monthly (24/7); Session if needed. ₿

⚠️Common pitfalls

Ignoring P: trading against the axis → stick with the side of P.

Chasing: entering right after break without retest/close → wait for confirmation.

News/open traps: violent candles plow levels → use time filters.

Crowded targets: plan stepwise partials across bands.

✅ Pre-trade checklist

Where is price vs P?

Which session is active; how much time remains?

Entry, partials, and stop vs levels/bands/mid-levels?

Any news in ±15 min?

Signal quality: Proximity → reaction? Close break → hold?

Management plan: partials, stop move, final target.

💡 use Meridian as a decision framework—bias from P, execution from zones, confirmation on close, disciplined exits by steps.

FAQ – Meridian Pivots Points Pro

It combines session awareness, auto presets, and clean visual zones so you immediately see where price is likely to react and get alerted only when it matters.

Start with Standard for classic behavior. Use Fibonacci for smoother proportional targets, Camarilla for mean-reversion, Woodie for close-weighted pivots, and DeMark when you want the minimalist R1/S1 framework.

It builds pivots from the previous session window (e.g., London) and applies them to the current session. You can select the session preset and timezone so levels align with your trading hours.

If you choose UTC in Session Timezone, sessions align to real session hours. Broker uses your broker’s server time. CustomOffset lets you shift minutes if needed.

When Preset Mode = Auto, the indicator recognizes supported symbol + timeframe combinations and applies a tuned configuration (period type, levels, mid-levels, etc.). The HUD shows the preset name when active.

No. Presets never touch your Sound on Cross or Sound on Proximity toggles.

Green bands fill from S-levels up to P (support zones). Red bands fill from R-levels down to P (resistance zones). The P line is blue. Adjust “Fill Opacity” to taste.

Optional mid-levels: MR1 is the midpoint between P and R1, MS1 is the midpoint between S1 and P—useful as intraday reaction lines.

Top-left: Nearest level with distance in pips and price.

Top-right: ● Preset: <name>. The dot turns green when an auto preset is active.

Yes – enable Show History and set Lookback Periods. The indicator draws previous periods applied to their following periods, so you can study how price reacted.

Forex, indices, metals, oil, and crypto—scalping to swing. Auto presets cover popular combinations (EURUSD M30, GBPUSD M15, USDJPY M5, XAUUSD M15/H1, US100 M5, USOIL M15, BTC/ETH H1, DAX M5). Everything else works with your manual settings.

Themes change colors and opacity of lines/labels, and fills if enabled. If your chart background is similar in tone, try LightPro for white charts or DarkNeon for dark charts, and raise Opacity (Lines) and Fill Opacity.

Daily/Weekly/Monthly use the last closed period as the source for the current one. Session uses the last session window for the current session (e.g., prior London → current London).

Turn on Cross on Close for cleaner signals (less noise). Use Proximity to prepare for touch tests or breakouts (set a realistic pip distance for your symbol’s volatility).

Set Active Days = FullWeek so sessions continue through Saturday–Sunday.

Switch Session Timezone to UTC, or use CustomOffset to nudge minutes until the opening/closing lines align with the times you expect.

Yes – on Weekly pivots, see where price trades relative to P and major R/S. Combine with Daily/Session pivots for pinpoint entries.

For intraday, 3-4 R/S levels are usually enough. For swing, you may enable 5. Too many levels can clutter – use mid-levels sparingly.

If your chart is busy, turn off Show History or reduce Lookback Periods, and use Medium/Low fill opacity.

It means there’s no auto preset for that symbol + timeframe. You can still set everything manually (or tell us your favorite pair/TF – we’re extending the library).