Samurai Breakout Pro II for cTrader – Session Breakout Workstation ⚔️

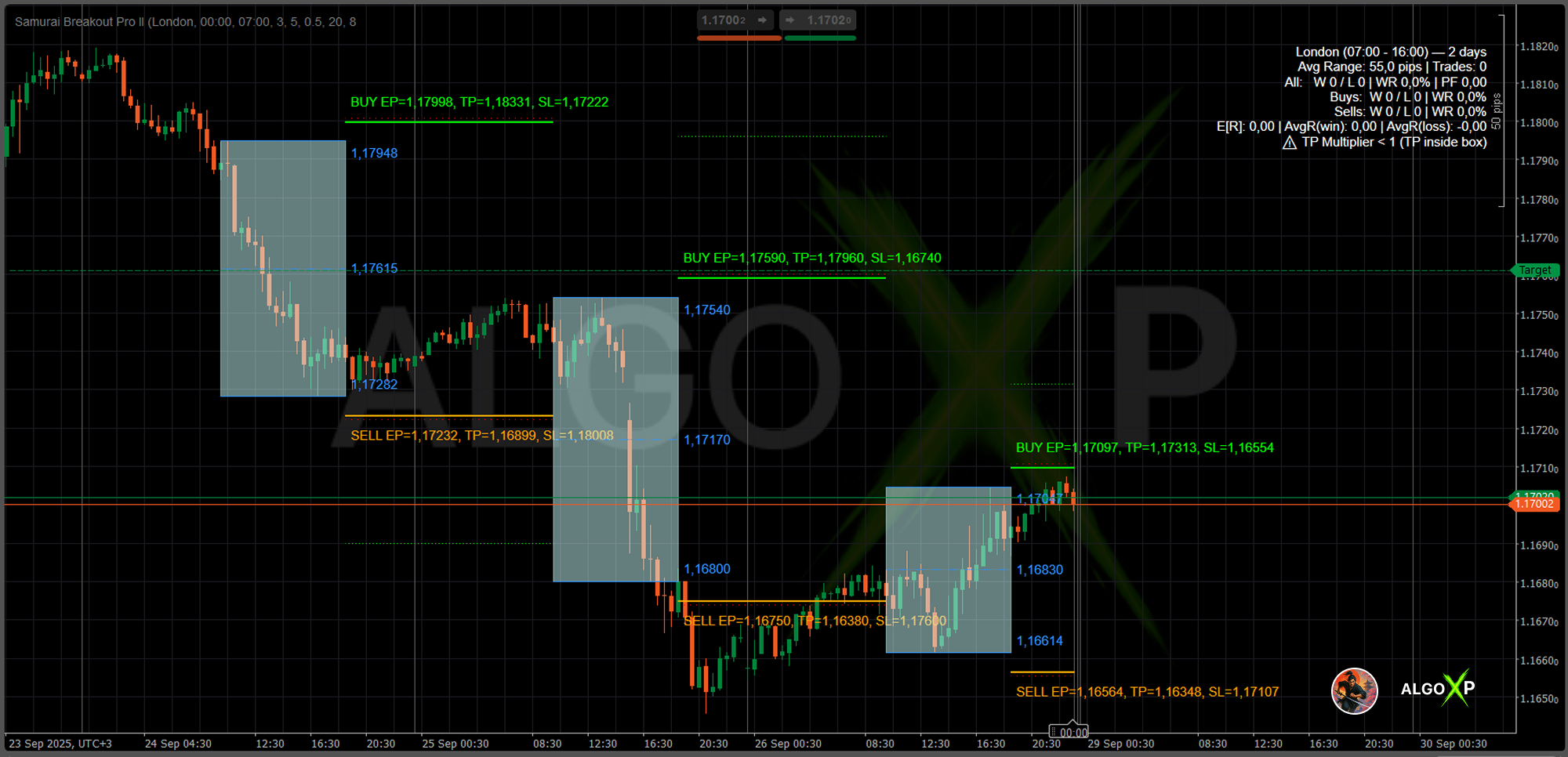

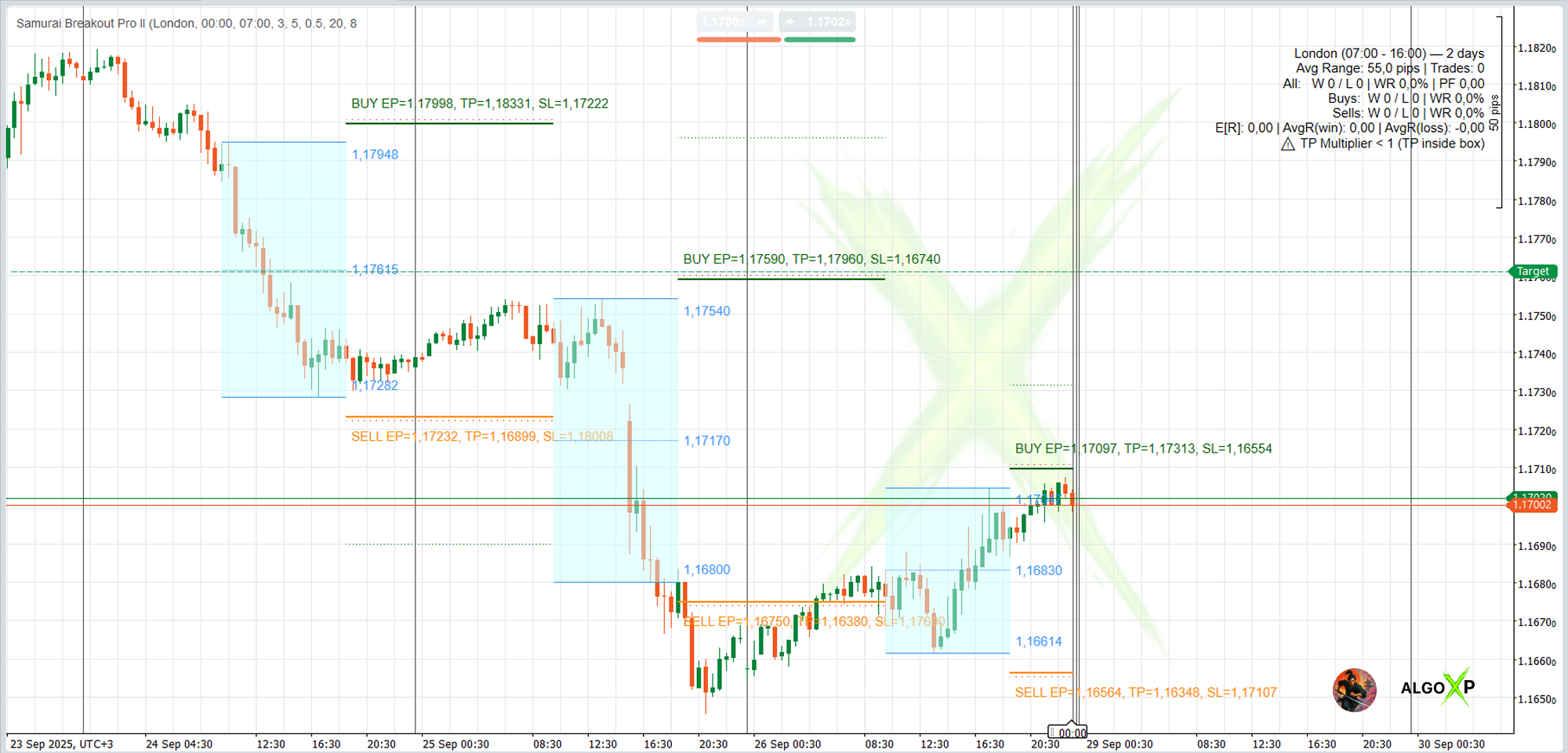

Samurai Breakout Pro is a professional version of the breakout indicator that automatically plots the Asian session range and provides entry, stop loss, and take profit levels.

Unlike the Lite version, the Pro edition includes a performance statistics panel that tracks wins, losses, average range size, and success rate over a configurable history period and also gets full visual customization.

It is designed for traders who want more than just breakout levels – Pro adds tools for back-visual analysis, optimization, and disciplined strategy testing.

It’s a second version of legendary JPY Samurai Breakout Pro indicator.

More pro features and clear visiability.

✅ Main Features:

- Session-aware box: presets for Tokyo/London/NY/Overlap + Custom (UTC); lines drawn only over the active trading segment.

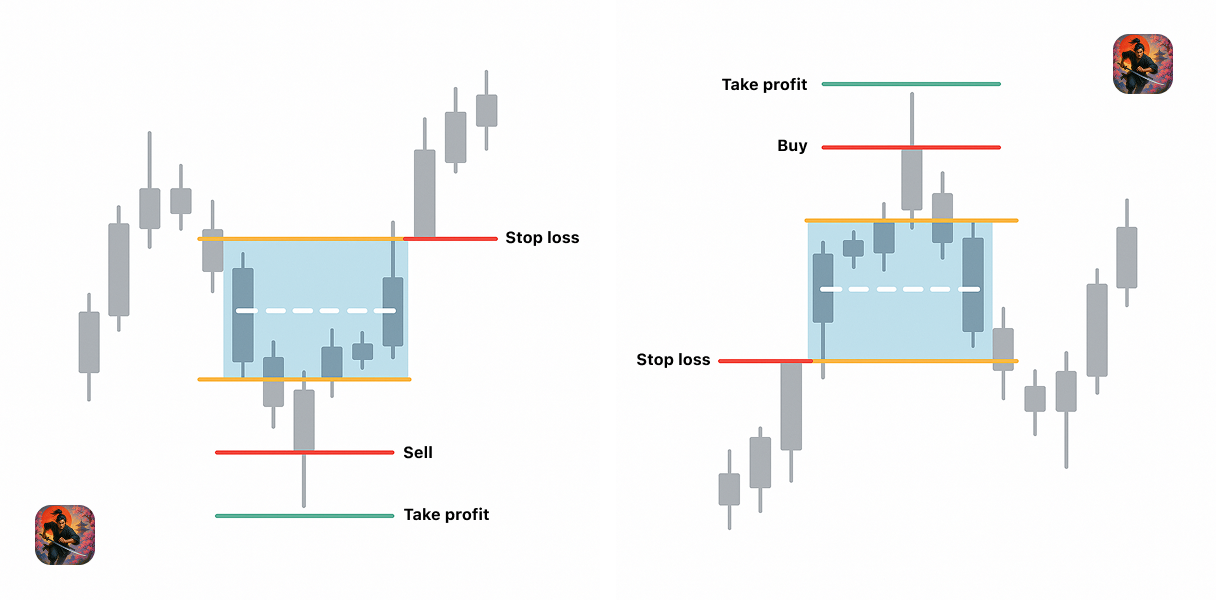

- Auto EP/TP/SL: entries, take profits, and stops with precise price labels placed exactly where they’re easiest to read.

- On-chart R analytics: E[R], Profit Factor, Avg R(win/loss), Win/Loss with separate Buy/Sell counts, and #Trades.

- ATR-Smart mode: offset and/or TP derived from ATR → one setup that travels across markets and timeframes.

- Trend filter (EMA): trade in the direction of the EMA slope with price on the correct side.

- Break-&-Retest: confirm the breakout via a pullback to edge/mid within X% of the box—fewer false starts.

- Day quality filter: Min/Max Range plus a warning when the box/spread relationship is unfavorable.

- On-chart outcomes: compact ✓/✗ markers above the box and a concise HUD with aggregated stats.

- Instant historical testing: History Days recalculates and displays outcomes for each prior day.

- Clean design: themes, crisp typography, and minimal chart clutter for fast visual decision-making.

🎯 Perfect for:

- Day and swing traders who trade breakouts/impulses inside session windows (Tokyo, London, NY, Overlap).

- Manual traders who want to quickly tune levels to their style and see results directly on the chart.

- Forex, gold, indices, oil, and crypto traders needing a portable logic across symbols and timeframes.

- Risk-management practitioners who evaluate systems via R-metrics (E[R], PF, AvgR) and Buy/Sell splits.

- Breakout newcomers seeking clean visuals, intuitive session presets, and quality hints (spread vs. range).

- Advanced users who want PRO controls: ATR-Smart, EMA trend filter, Break-&-Retest, and flexible range filters.

⚡ Why Pro?

- Perfect for systematic and professional traders.

- Adds discipline and data to breakout trading.

- See exactly how often your strategy wins or loses.

- Advanced customization and full control of parameters.

How Samurai works – in 5 steps

- Choose a session

Select a built-in preset (Tokyo, London, New York, Overlap) or create a custom session by UTC time. - Samurai draws the box

During the session, Samurai draws a price range box that defines your breakout zone. - Define your breakout rules

Set offset from the box, TP/SL model (box multiples or ATR multiples), and filters like EMA trend or Break-&-Retest. - Samurai marks entries and outcomes

When price breaks the box according to your rules, Samurai marks the entry, take-profit, or stop-loss on the chart. - Review performance at a glance

Samurai calculates WinRate, E[R], Profit Factor, average R(win/loss), Buy/Sell split, and more — directly on your chart for the selected history window.

Review performance at a glance

Samurai calculates WinRate, E[R], Profit Factor, average R(win/loss), Buy/Sell split, and more — directly on your chart for the selected history window.

Monitor the statistics panel in the top corner to see how many setups succeeded historically (Wins, Losses, WinRate).

Adjust filters (Min/Max Range, Entry Offset, SL Offset) to optimize the breakout setups for your preferred pair.

Why traders use Samurai Breakout Pro II

- Session-aware presets

Built-in templates for Tokyo, London, New York, and Overlap sessions, plus custom UTC sessions. - Clean, focused chart

Lines and labels appear only in the active trading window. No clutter, no spaghetti. - On-chart R-analytics

WinRate, E[R], Profit Factor, average R(win/loss), Buy/Sell split, and more — for your current settings and history window. - ATR-smart portability

ATR-based offsets and targets allow one setup to travel from Forex to gold, indices, oil, and even crypto. - Quality filters

EMA trend filter, Break-&-Retest, Min/Max Range, and spread vs box hints to help filter noisy sessions. - Lite version available

Start with Samurai Lite to learn the logic and workflow. Upgrade to Pro when you’re ready.

What Samurai Breakout Pro II is – and what it is NOT

Samurai is:

- A workstation for building and testing session-breakout playbooks

- A visual tool that turns your ideas into repeatable rules

- A way to evaluate breakouts using R-multiples and robustness, not just screenshots

Samurai is NOT:

- A guarantee of profit or a “money-printing” system

- A grid or martingale strategy

- A replacement for proper risk management, journaling, or common sense

Samurai is a tool for serious traders who are ready to test, iterate, and own their decisions

Samurai Breakout Pro II – Parameters Overview

Session Preset

Defines which market window is used to build the session box.

Options: Tokyo, London, New York, Overlap, Custom.

Use: quickly align the indicator with common liquidity rhythms without manual time input.

Session Start / End (UTC)

Time window used to scan price action and form the session High and Low.

Default (Tokyo): 00:00–07:00 UTC.

Adjusting this window changes the box size and placement. Choose the hours that best match your strategy (e.g., pure Tokyo, London, or a custom overlap).

Session Time Base

Specifies which clock you use when entering session hours.

Options: UTC, CustomOffset.

- UTC: enter times in UTC (recommended for consistency).

- CustomOffset: enter local times and set your offset in Custom Offset (hours).

Custom Offset (hours)

Offset to UTC used when Session Time Base = CustomOffset. Range: −14 … +14.

Examples: Madrid = UTC+2 → 2; New York (summer) ≈ UTC−4 → -4.

Overnight Sessions

If the window crosses midnight (e.g., 23:00 → 06:00 in your chosen base), the end is correctly placed on the next calendar day. The current active box is always anchored to the most recent actual start, so the nearest session is visible on the right edge of the chart.

History Days

How many previous days are analyzed and drawn.

Typical: 5–20.

Each day’s box is drawn separately, so you can visually compare past breakouts. The statistics panel (Wins, Losses, Win Rate, R-metrics) uses this value to compute averages and success rates.

Smaller values (3–5) focus on the most recent regime; larger values (20–30) highlight longer-term tendencies.

Logic Parameters

Entry Offset (pips)

Distance for breakout entries above the box High (Buy) and below the box Low (Sell).

Purpose: filter small wicks and weak pokes.

- Example: High = 150.00, Offset = 5 → Buy Entry = 150.05.

Larger offsets reduce noise but may skip tight breakouts. Start small; scale with instrument volatility.

Note: if Use ATR for Offset = ON (see Pro Settings), this pip value is overridden by k × ATR / PipSize.

TP Mode (Take Profit model)

Selects how TP distance is computed.

- BoxMultiple (classic):

TP = Box Range × TpMultiplier. - ATRMultiple (portable):

TP = AtrTpK × ATR.

Choose BoxMultiple for pure range logic, ATRMultiple for cross-symbol/timeframe portability.

Take Profit Multiplier (BoxMultiple only)

Multiplier applied to the box height to set TP distance.

- Example: Box = 25 pips, Multiplier = 2.0 → TP = 50 pips from entry.

Bigger multipliers target extended runs; smaller lock in quicker profits.

Ignored when TP Mode = ATRMultiple.

Stop Loss Placement

SL is automatically placed beyond the opposite side of the box (with a small internal offset to avoid overlapping lines).

- Even with Entry Offset = 0, SL remains clearly separated for readability.

No user input is required for SL distance in this build—keeps charts clean and rules consistent.

Min Range / Max Range (pips)

Filters out invalid session boxes.

- If the box is too narrow (< Min) → likely noise → skip.

- If the box is too wide (> Max) → overextended → skip.

Example: Min = 20, Max = 80. A 10-pip box is skipped; a 150-pip box is skipped.

This prevents unrealistic or low-probability breakouts from polluting your stats.

Visibility Parameters

Show Mid Line

Toggles the midpoint between High and Low.

Useful as a visual balance line and, in Retest mode, as an optional pullback anchor.

Show Entry Levels

Draws Buy/Sell Entries with corresponding SL and TP for the active trading segment only (from session end to the next session start).

On: full breakout plan on chart.

Off: only the session box for pure range analysis.

Show Prices Near Lines

Displays concise labels near lines (and compact strings like EP=…, TP=…, SL=…) in color-coded, easy-to-read positions.

Turn OFF for ultra-minimal charts.

Show Stats

Shows the performance panel in the top corner.

Panel includes All/Buys/Sells (Wins/Losses/WR%), #Trades, Average Range, and R-metrics (E[R], PF, Avg R(win), Avg R(loss)), plus smart warnings.

Turn OFF for a cleaner canvas.

Color & Style Parameters

Color Theme

Overall style: Dark, Light, or Custom.

Dark/Light = curated palettes; Custom = manual control of all colors.

Box Color (Custom)

Fill color of the session box (semi-transparent).

Makes the breakout zone immediately distinguishable from the rest of the chart.

Line Color (Custom)

Color of the box High/Low/Mid lines.

Entry Buy / Entry Sell Colors

Custom colors for Buy and Sell entry lines.

Common practice: green for Buy, orange/red for Sell for instant direction recognition.

TP Color / SL Color

Distinct colors for Take Profit and Stop Loss lines.

TP should contrast with entries; SL is often red for risk awareness.

Stats Color

Color of text in the statistics panel when Custom theme is active.

Defaults adapt to Dark/Light for readability.

Pro Settings • ATR Smart

Use ATR for Offset

When ON, the entry offset is computed as Offset = AtrOffsetK × ATR / PipSize (overrides Entry Offset (pips)).

This scales entries to volatility and makes setups transferable across symbols/timeframes.

ATR Period

ATR lookback used for both ATR offset and ATR TP when enabled.

Typical starting point: 14.

Offset K (k × ATR)

Coefficient for ATR-based entry offset.

Larger k → more conservative entries; smaller k → more frequent signals.

TP Mode (revisited)

- BoxMultiple: use Take Profit Multiplier (ignores ATR for TP).

- ATRMultiple: use TP ATR K (m2 × ATR) (ignores TpMultiplier).

Priority rules: - If Use ATR for Offset = ON, pip offset is ignored.

- If TP Mode = ATRMultiple, TpMultiplier is ignored.

All other Logic parameters (including Min/Max Range) remain active.

TP ATR K (m2 × ATR)

Coefficient for ATR-based TP distance when TP Mode = ATRMultiple.

Higher values aim further targets; lower values secure profits sooner.

Pro Settings • Trend

Trend Filter (EMA)

Allows trades only in the EMA slope direction and with price on the correct side of EMA (buy above & rising, sell below & falling).

This is a simple and effective quality gate for momentum alignment.

EMA Period

Lookback length for the EMA trend filter.

Shorter = more responsive; longer = more stable.

Pro Settings • Break & Retest

Retest Enabled

When ON, a valid entry requires:

- initial touch of EP,

- pullback to the chosen anchor (edge or mid) within the defined percentage of the box,

- renewed break.

This removes many “first-poke” false breakouts.

Retest Pullback % of Box

How deep the pullback must be, expressed as a percentage of box height.

Larger % = stricter confirmation; smaller % = more frequent but looser confirmation.

Retest Anchor

Where the pullback should land:

- BoxEdge: the nearest box boundary (High for buys, Low for sells).

- MidLine: the middle of the box—useful in balanced conditions.

Statistics & Analysis

When Show Stats is enabled, the indicator calculates and displays:

- Average Range — mean session box size over History Days.

- Wins / Losses — total outcomes; also split into Buys and Sells.

- Win Rate (WR%) — wins ÷ total trades × 100.

- #Trades — total counted trades over the lookback.

- R-metrics(professional risk view):

- E[R] (Expectancy) — average result per trade in R, where R = |Entry − SL|.

- Profit Factor (PF) — sum of positive R ÷ sum of negative R.

- Avg R(win) and Avg R(loss) — average magnitude of wins and losses in R.

- Smart Warnings — automatic hints if parameters look unrealistic:

- Entry Offset too large → entries may be off-screen or miss the move.

- TP Multiplier < 1 (BoxMultiple) → TP sits inside the box (unrealistic).

- Box filtered → range outside Min/Max (skipped).

- Spread too large vs box → poor quality day for tight breakouts.

On-chart outcomes: each day’s trade result is marked ✓/✗ above the box near the right edge of the entry window, so you can verify setups visually at a glance.

Tip: After tuning any parameter, scroll a few History Days and confirm that WR% is reasonable, E[R] > 0, PF > 1, and there are no warnings. That’s your green light that the configuration is robust for current market conditions.

Quick Troubleshooting

- Box appears “yesterday” → check Session Time Base and Custom Offset; use or

CustomOffsetfor local entry. - No trade/lines today → ensure box size passes Min/Max Range and Show Entry Levels = ON.

- TP won’t change → verify TP Mode: with

ATRMultiple, TP uses TP ATR K, not TpMultiplier.

How to validate a breakout idea with Samurai

- Define the idea

Example: “London session breakout on EURUSD H1 with 2R targets.” - Set up Samurai

Choose the session preset, select BoxMultiple or ATRMultiple mode, configure Offset, TP, SL, and filters. - Pick a History window

Use Samurai’s history settings to review the last 20–40 days (or more). - Scroll and observe outcomes

Look at ✓/✗ marks, R-multiples, WinRate, E[R], and PF.

Focus on robustness — not on the one best day. - Adjust filters, not past trades

Use EMA trend, Range filters, and Retest logic to filter out low-quality conditions instead of curve-fitting every loss. - Log and decide

If the idea shows acceptable E[R], PF, and drawdowns over enough trades, move it to demo and continue monitoring before going live.

Samurai’s job is to make this process fast, visual, and repeatable.

How to trade

Attach to any symbol & timeframe

Works across Forex majors/minors, gold/silver, indices, oil, and crypto on M15–H1 (intraday) and H4–D1 (swing). The logic is portable; only the parameters change with volatility.

Choose your trading session

- Preset: Tokyo, London, New York, or Overlap for common market rhythms.

- Custom: set Start/End in UTC for your broker or strategy hours.

After the session closes, the indicator draws the Box: High, Low, and optional Mid.

Understand the breakout levels (auto-plotted)

- Buy Entry (EP Buy): placed above High by a configurable offset.

- Sell Entry (EP Sell): placed below Low by a configurable offset.

- Stop Loss (SL): beyond the opposite edge of the box (auto).

- Take Profit (TP): distance measured from Entry by your chosen model (see step 4).

Lines are drawn only for the active trading window (from session end to the next session start), with readable price labels.

Pick your TP/Offset model (two professional options)

- BoxMultiple (classic box logic):

- Entry Offset: start with a small, instrument-aware value (e.g., 3–7 “pips” on typical FX majors; scale with volatility).

- TpMultiplier: 1.5–2.5 (TP = multiplier × box height).

- ATRMultiple (portable across markets/TFs):

- Turn Use ATR for Offset = ON and set AtrOffsetK ≈ 0.4–0.7.

- Set TP Mode = ATRMultiple with AtrTpK ≈ 1.5–2.5 (TP = m2 × ATR).

Priority rules:

• If Use ATR for Offset = ON, the pip offset is overridden byk×ATR.

• If TP Mode = ATRMultiple, TpMultiplier is ignored.

Everything else in Logic (e.g., Min/Max Range) stays active.

Control day quality & reduce noise

- Min/Max Range (pips): skip days where the box is too narrow (prone to chop) or too wide (late/overextended).

- EMA Trend filter (optional): allow trades with the EMA slope and on the correct side of EMA.

- Break-&-Retest (optional): after the first EP touch, require a pullback to the edge or mid within X% of the box, then a renewed push—cuts many false breaks.

Read the on-chart analytics—no external reports needed

- Outcome markers ✓/✗ appear above the box as soon as TP/SL (or cutoff close) decides the trade.

- Stats panel (top corner) shows:

• Wins/Losses total and Buy/Sell split

• WinRate and #Trades

• R-metrics: E[R] (expectancy per trade), PF (Profit Factor), Avg R(win), Avg R(loss) - Smart hints: warnings if TP sits inside the box or if box/spread ratio is poor.

Test on recent history, right on the chart

Set History Days (e.g., 5–20) to instantly see past boxes, entry lines, outcomes, and aggregated performance. This is A/B testing without spreadsheets.

Refine to your style (simple rules of thumb)

- Want cleaner, more selective entries → increase Offset or enable Retest.

- Want more frequency → decrease Offset or relax Range limits.

- Validate viability: look for reasonable WinRate, E[R] > 0, PF > 1, and no quality warnings.

Example starting points (tune to your market & TF)

- FX majors (H1):

Session: London or NY. BoxMultiple: Offset 3–6, TpMultiplier 1.8–2.2. EMA 50: ON. Retest: OFF (turn ON on noisy days). - Gold (M30/H1):

Use ATR mode: Use ATR for Offset ON (0.5–0.7), TP Mode = ATRMultiple (1.8–2.3). EMA: ON. Retest: ON in higher vol. Adjust Min/Max Range to your broker’s point size. - Crypto (M15/H1):

ATR mode (Offset + TP), ATR 14; EMA 50: ON; Retest: ON. Consider wider Min/Max Range due to 24/7 volatility.

Pro tip: after any change, review History Days and re-check E[R] and PF. If expectancy stays positive and PF > 1 with acceptable WinRate, you’re dialed in.

Samurai works best for:

- Day and swing traders who watch Tokyo / London / New York / Overlap sessions

- Forex, gold, indices, oil, and crypto traders who like clean, rule-based entries

- Traders and prop traders who evaluate systems in R-multiples, not in “pips per day”

- Those who want a repeatable breakout playbook, not one-off chart “ideas”

Samurai is not a good fit if:

- You never consider sessions or time-of-day in your trading

- You only want fully automated “set & forget” bots and don’t care about the logic

You expect a fixed monthly % return from any indicator or strategy

Platform & integration

- Platform: cTrader

- Works on: Forex, metals, indices, oil, crypto (depending on your broker)

- Usage:

- Standalone manual trading tool

- Part of a discretionary/systematic breakout framework

- Helper for designing and validating strategies before building full cBots

You can install Samurai on multiple symbols and timeframes to build a complete session-breakout workspace.

Trusted inside the cTrader ecosystem

Samurai Breakout Pro II is available in the official cTrader Store with public ratings and reviews.

- Rated 5.0 ★ on cTrader Store

- Used by traders across Forex, metals, indices, oil, and crypto

VIEW SAMURAI BREAKOUT PRO II ON CTRADER STORE

Risk & disclaimer

Samurai Breakout Pro II is a tool, not a guarantee of profit.

- All examples on this page are illustrations, not promises of future performance.

- Past performance – including any backtests – does not guarantee future results.

- Trading leveraged products (Forex, CFDs, crypto, etc.) carries a high level of risk and may not be suitable for all investors.

- Always test on historical and demo data with your own broker conditions (spread, commission, slippage).

- Never risk money you cannot afford to lose.

FAQ – Samurai Breakout Pro II

No. Samurai is an indicator and a workflow tool for session breakouts. It helps you define, test, and execute rules. You still decide when and how to trade.

Samurai was designed primarily for Forex session breakouts on M15–H1, but many traders also use it on gold, indices, oil, and crypto. Always test on your own markets and timeframes.

A professional session-breakout indicator for cTrader. It builds a session box (High/Low/Mid), auto-plots EP/TP/SL, marks trade outcomes ✓/✗ on the chart, and provides pro R-analytics (E[R], PF, Avg R(win/loss), Buy/Sell split). It also includes ATR-Smart controls, an EMA trend filter, and Break-&-Retest – so you can tune and validate a breakout plan directly on the chart.

For day & swing traders across Forex, metals, indices, oil, and crypto who want a clear, rules-based breakout workflow and on-chart testing. Compared with generic “box” tools, Samurai adds portable ATR-based offsets/TP, Buy/Sell split stats, full R-metrics, optional Retest & EMA filtering, crisp price labels, and lines drawn only over the active trading segment—faster decisions, less clutter.

No. Only the explicitly ATR-driven fields are overridden: Offset (if Use ATR for Offset = ON) and TP (if TP Mode = ATRMultiple). Min/Max Range and others remain active.

By default, by wick (High/Low). There’s a hidden switch for “by close,” but wick entries are more consistent for breakouts.

At the cutoff (start of the next chosen session) by the last available Close before cutoff.

R = |EP − SL|. Trade result in R is Profit/Loss divided by R. Samurai shows E[R], PF, Avg R(win/loss).

Samurai tracks Buy wins/losses and Sell wins/losses independently, plus totals.

Check TP Mode. If it’s ATRMultiple, TP is taken from TP ATR K (ATR-based), not from TpMultiplier.

The indicator runs in UTC (TimeZone = UTC). If your broker time differs, account for the offset.

Average box size vs current spread is too small (e.g., ratio < ~6). These days are low-quality for tight breakouts.

It removes many “first poke” fakes: we require an EP touch, a pullback to edge/mid within X% of the box, then a renewed break.

Yes. Toggle Show Prices Near Lines = OFF.

No. EP/TP/SL are drawn only across the trading segment (from session end to cutoff). Each day’s lines stop before the next box.

Samurai safely falls back: TP from TpMultiplier × box, and Offset from Entry Offset (pips).

It allows trades only in the slope direction and with price on the appropriate side of EMA (buy above & rising; sell below & falling).

Yes. A ✓/✗ marker appears above the box at the right edge; you also see compact EP/TP/SL strings if labels are enabled.

Up to your chosen History Days (typical: 5–20). It stays responsive—drawing only relevant segments. Maximum 60 (use maximum only for test your strategy, because it’s loaded you PC)

Preset London, Range 20-120, Offset 3-6 pips, BoxMultiple with TpMultiplier 1.8-2.2, EMA 50 ON, Retest OFF (ON on noisy days).

Use ATR mode: Use ATR for Offset = ON, TP Mode = ATRMultiple, AtrOffsetK ~0.5-0.7, AtrTpK 1.8-2.3; add Retest in high vol.

Retest is a quality gate – fewer but cleaner entries. If you want more frequency, reduce Retest Pullback % or disable Retest.

Look for E[R] > 0, PF > 1, reasonable WR%, and no warnings (TP inside box; poor box/spread ratio).

Yes conceptually – simply follow the side that your stats show as stronger. (If you want a strict one-side mode, we can add a toggle.)